GME’s Business Model and Stock Price Appear to be in Terminal Decline

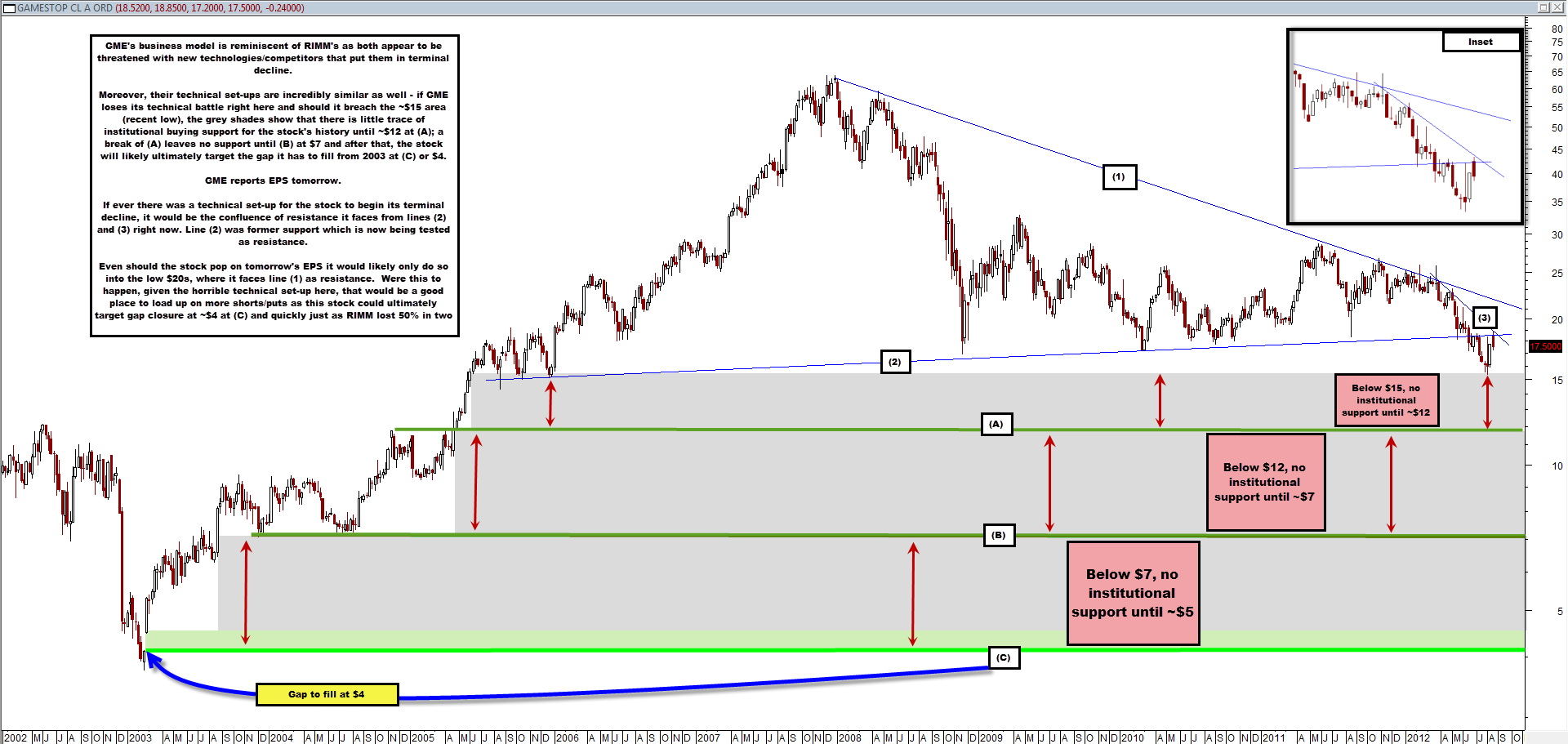

We’ll limit the commentary in this post as our thoughts are clearly outlined in the chart below (which we produced yesterday – GME reported EPS this morning), but broadly speaking, we think the prospects for this company’s business model and stock price are likely in terminal decline.

There will be short squeeze pops in the stock from time to time when PE is rumored to be interested in acquiring the biz, but the same has been true for other companies in terminal decline that seemingly have a lot of cash and still produce lots of it from operations (think RIMM, BBY, NOK, etc.).

Is GME ultimately going to $4?

Comments are closed, but trackbacks and pingbacks are open.