Break-Outs in Global Equity Indices / Lessons from PTJ

The charts below highlight that many global equity indices across North America, Europe and Asia are all concurrently breaking above trend-line resistance.

Some break-outs are clearing resistance dating back to 2007 and others more recent resistance dating back to 2010.

Such strength could lead to further upside moving forward, especially in areas which are Euro-centric, as we’ve been pointing out for months, which have badly under-performed other regions in the recent past.

If more upside does occur, we might look back on this moment as one of those special crossroads for market participants – the point at which the wheat is separated from the chaff when it comes to defining great traders/investors vs. average or poor ones.

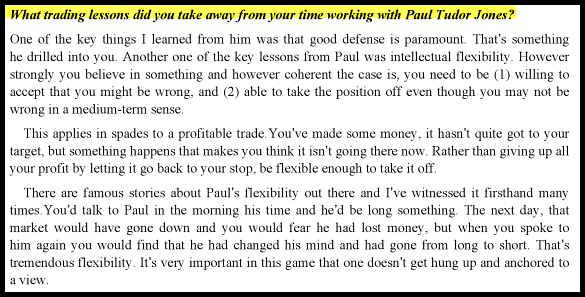

If these break-outs are real, the great ones, the PTJs of the world, will accept that risk assets are moving higher and find a way to participate, even if they were previously bearish.

Others will dig in and cling to their belief that risk assets “shouldn’t” or “can’t” move higher because globally, things are “so bearish”.

If risk assets do continue higher and one finds themselves struggling to participate in the upside because of pre-existing bearish biases (or vice versa if bullish and risk assets start heading lower), hopefully the excerpt below from “Inside the House of Money“, whereby a fund manager who used to work for PTJ discusses that experience and his extreme flexibility, can provide the inspiration to check such biases at the door and move on.

Comments are closed, but trackbacks and pingbacks are open.