Despite Pledge of Infinite QE from Fed, Commodities Under-Performing over Past Week

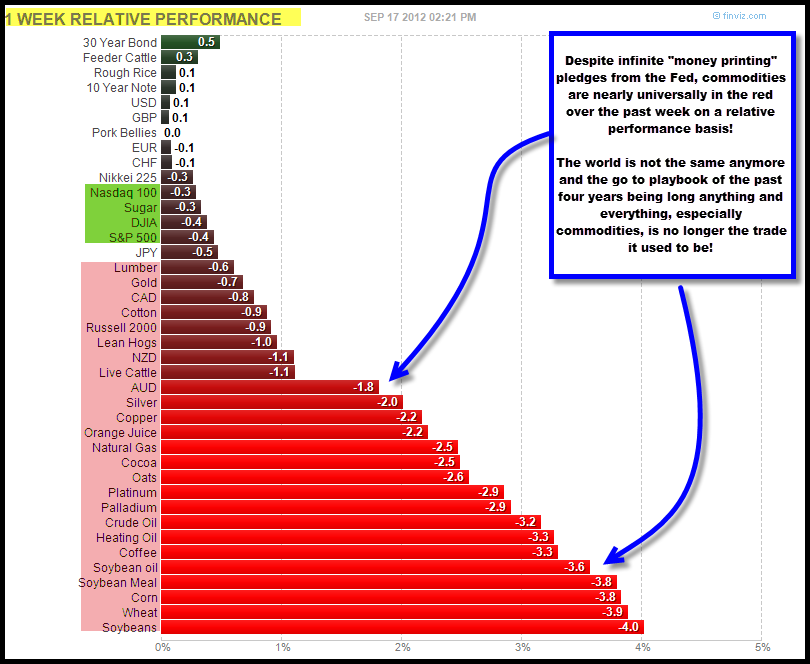

The table below shows the one-week relative performance of global macro assets.

This is an important table to think about given the material announcement from the Fed last week that it will be doing open-ended QE for the forseeable future.

Despite this potential panacea for macro commodities, notice that nearly universally they have under-performed over the past week both vs. UST prices, the USD and domestic equities!

This is quite remarkable to us.

In our view, as we have highlighted before, it tends to suggest that the playbook of the past decade (i.e., commodities out-perform everything else) and over the past four years (i.e., risk on/risk off) is potentially in the rear-view mirror.

As a caveat, this does not necessarily imply that ALL commodities need to under-perform.

Could commodities under-perform while gold out-performs? Yes. Could gold out-perform as silver under-performs? Yes.

Just different possibilities to think about as the framework of the past few years seems to be subtly shifting.

Comments are closed, but trackbacks and pingbacks are open.