Biotechs Should Continue to Out-Perform Materially

On July 16th we noted pharma and biotechs were working on noteworthy, long-term technical break-outs.

Regarding those groups, we said the following in that prior post:

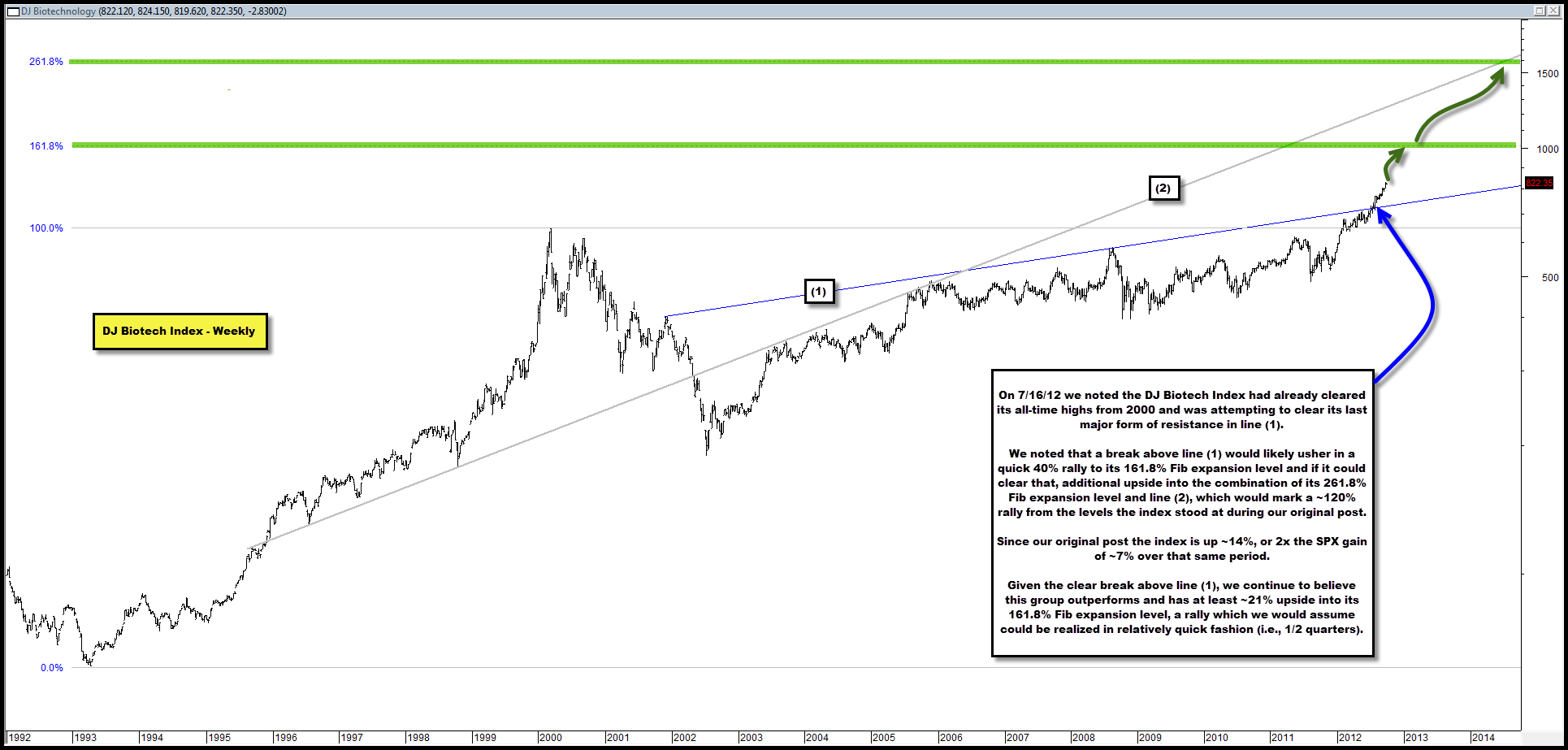

“The set-up in bio-tech is the most compelling given that the DJ Bio-tech index has already cleared all-time highs from 2000….Should it break its next line of resistance (line 1) currently at hand, there is little stopping it from rallying an additional 40% and potentially 120%, thereafter”.

We’ve updated the chart for bio-techs from our original post below.

As you can see, the index has definitively broken above line (1) to the upside with a 14% rally since our original post, twice the 7% rally in the SPX over the same period.

The next forms of resistance are the index’s 161.8% Fib expansion level, ~21% higher, and the combination of 261.8% Fib expansion and line (2) resistance, 95% higher.

Given this technical momentum and the lack of any resistance for the foreseeable future, we would reiterate our belief that bio-techs can continue rallying and out-performing the broader market.

Comments are closed, but trackbacks and pingbacks are open.