Euro Approaching Resistance

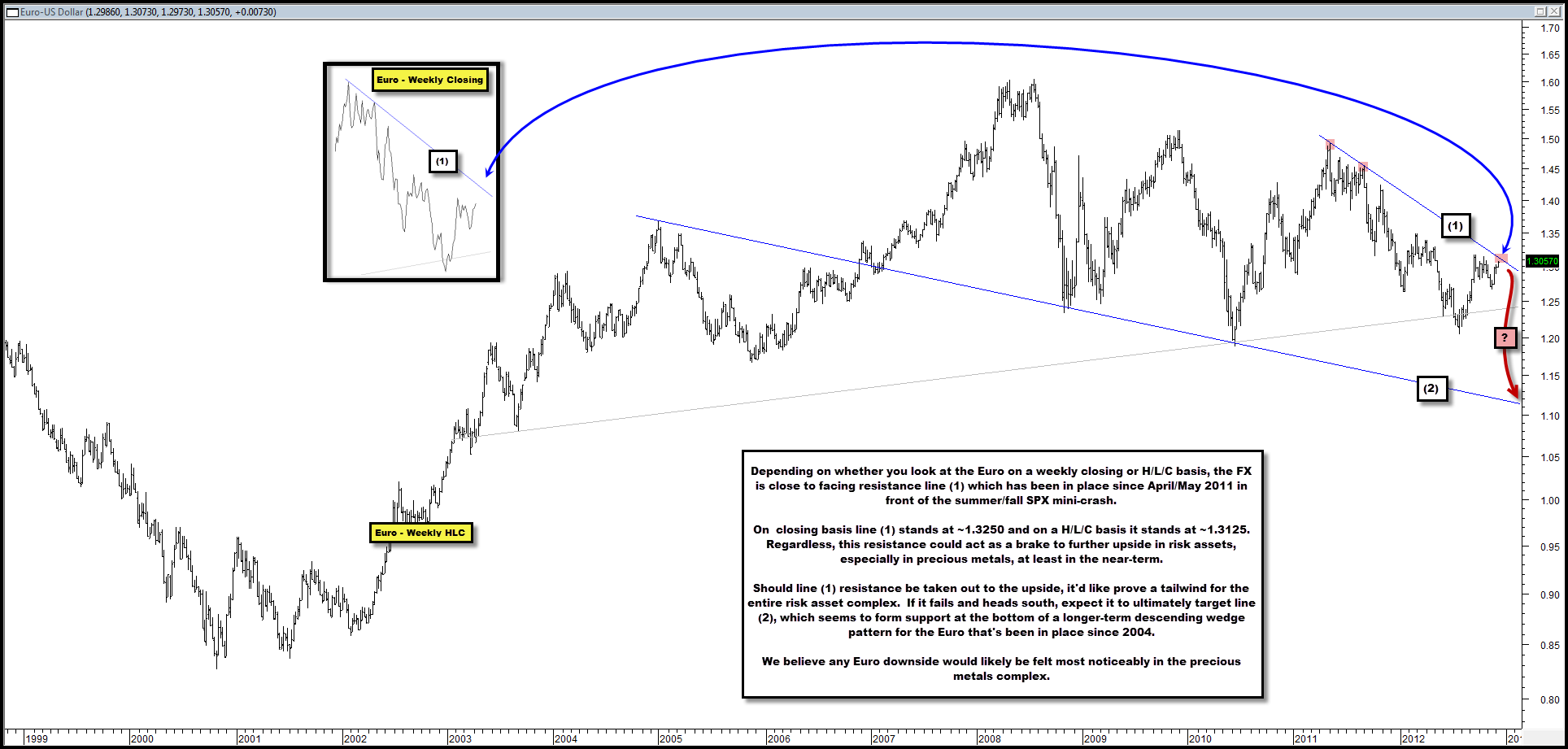

In the chart below the Euro is very close to reaching resistance line (1) which has been in place since April/May 2011 as global risk assets first began topping out in front of the summer/fall mini-crash in the SPX.

Using H/L/C bars, that resistance stands at ~1.3125, less than a penny above current levels.

However, at the inset, note this resistance, on a closing basis, is even higher, at ~$1.3250.

A break above line (1) could act as a tailwind for the entire risk asset complex and drive further upside in areas such as the SPX.

A failure at line (1) would likely implies the Euro ultimately targets line (2) support over the intermediate-term, which appears to be the bottom region of a descending wedge pattern the FX has traded in since 2004.

In our view, any near-term failure at line (1) resistance and/or downside in the Euro would be felt most noticeably/negatively in the precious metals complex.

Comments are closed, but trackbacks and pingbacks are open.