Fresh Thoughts on the Ongoing Short Yen Trade

Our first high conviction short Yen trade came on August 14th in this post.

At the time the Yen traded at ~1.27 vs. the current ~1.156, a decline of 9%+ over less than four months.

Not too bad of a move in FX-land.

Before we get into the details, we continue to advocate being short the Yen and our ongoing thesis has not changed.

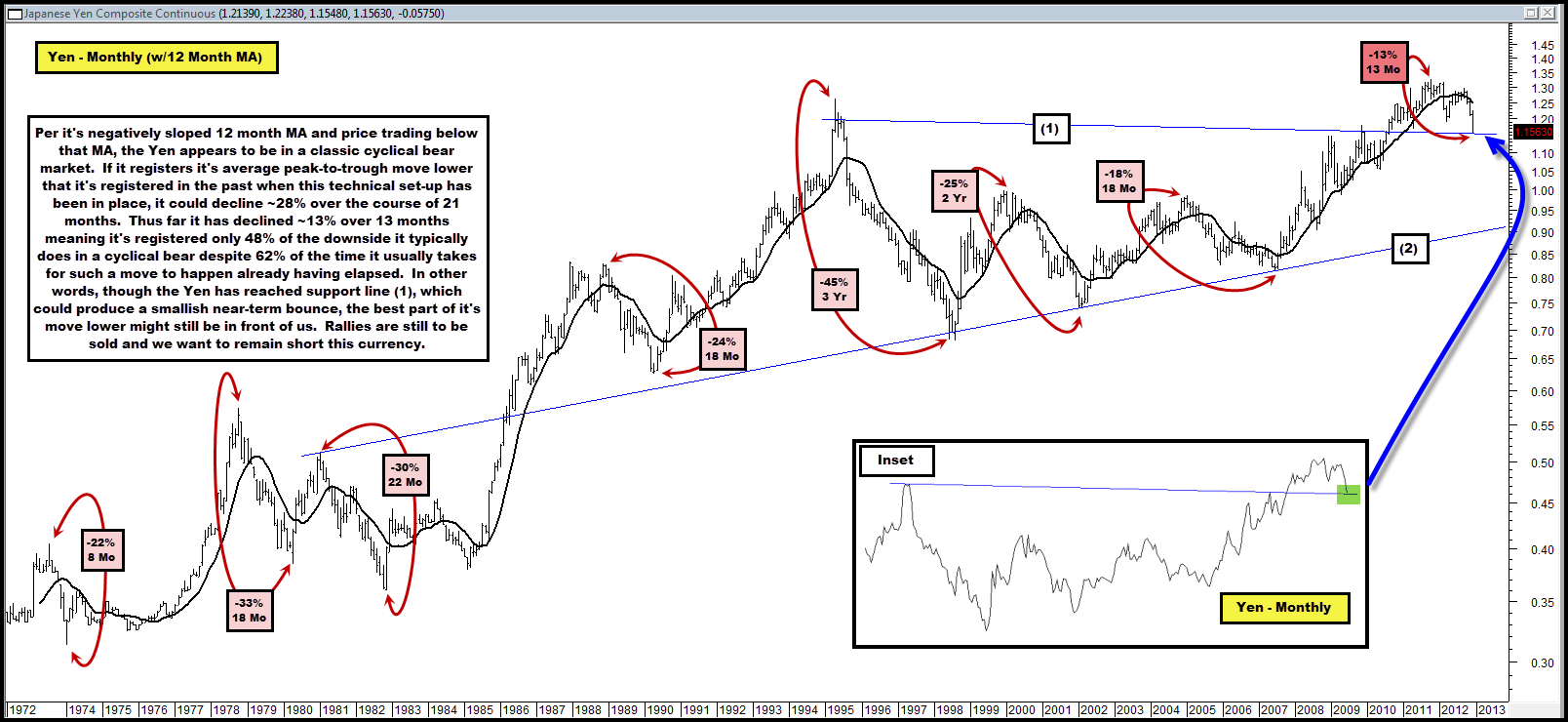

That being said, in the chart below the Yen short thesis faces what is its first noteworthy test, with support line (1) now at hand.

We would point out that line (1) is drawn across monthly closes, which for a different visual of the support we’re speaking of, can be seen at the inset.

In my view, any bounce at line (1) is apt to be short-term in duration and smallish in magnitude.

This belief is based on the Yen’s trading history dating back to the early 1970s.

Since that time whenever the Yen’s 12 month moving average (MA) rolls over and is negatively sloped and the Yen concurrently pierces through that MA to the downside, it typically portends accelerated and sustained moves lower in the currency.

We have highlighted all such instances on the chart. Of the seven examples highlighted and on average, the Yen has had peak-to-trough (i.e., intra-month peak to intra-month trough) declines of 28% lasting 21 months in duration.

Using the Yen’s intra-month peak of 1.3264 in November 2011 it has thus far declined ~13% over the course of 13 months.

Were the Yen’s current sell-off to approximate the average from the others in the chart in magnitude and duration, it’d need to decline another 16% to ~97 over the course of the next ~8 months.

My best guess is that if the Yen continues trading lower as I think it will, it will likely target line (2) which runs to ~90-95 and dates back all the way to the early 80s and runs below nearly every major swing low for the currency since the early 90s.

A move to that region would be a touch more than the average 28% peak-to-trough decline in this analysis, but again, that’s simply an average.

In conclusion, the key takeaways from this post should include the following:

- The Yen has reached support line (1) and is oversold; a near-term, smallish bounce could materialize

- Use any near-term bounce in the Yen as a selling opportunity as it is mired in a classic cyclical (and likely secular, but we don’t address that here) bear market as defined by its price action in the context of its 12 month MA

- Ultimate downside for the Yen could come in the 90-95 region atop line (2) support which dates back to the early 80s

- The best, meatiest part of the Yen’s downside is likely still to come as it’s registered 48% of the move lower it typically averages in a cyclical bear market despite the fact that 62% of the time it takes to register such moves is now behind us

For those that want to be short this currency, use the YCS ETF if not trading futures.

Comments are closed, but trackbacks and pingbacks are open.