Relative Industry & Associated Constituent Set-Ups

In the context of “needing” equity exposure, I present below a handful of relative industry set-ups that I find technically interesting. To reiterate, these are relative, not absolute industry out-performance ideas. In the event of major equity downside, consider them to be areas that lose less than the broader averages.

Regardless, I think they all have a combo of an interesting (bullish) technical patterns + favorable RSI deviations.

Note the prevalence of “stuff” or cash flow-producing hard assets in the industries presented – food retail; heavy construction; pipelines; real estate; retail REIT; steel.

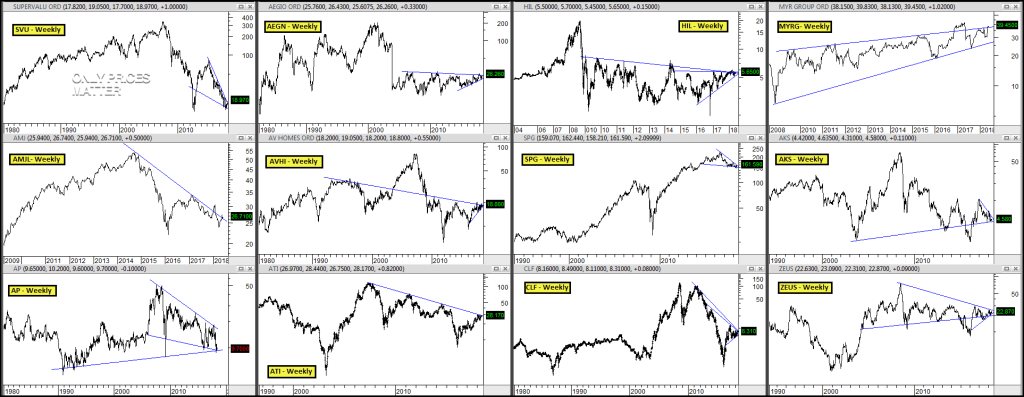

Here are a collection of individual names within the latter industries that I find appealing.

You’ll find that heavy construction and steel names pervade the list more so than the other industries. Both types seemingly fit within a broader Trump-macro thematic framework (heavy construction = infrastructure/wall; steel = tariffs).

Given so many steel names pepper the chart pack above, keep in mind the SLX ETF as an alternative way to gain exposure to the group w/o having to purchase all the individual names.