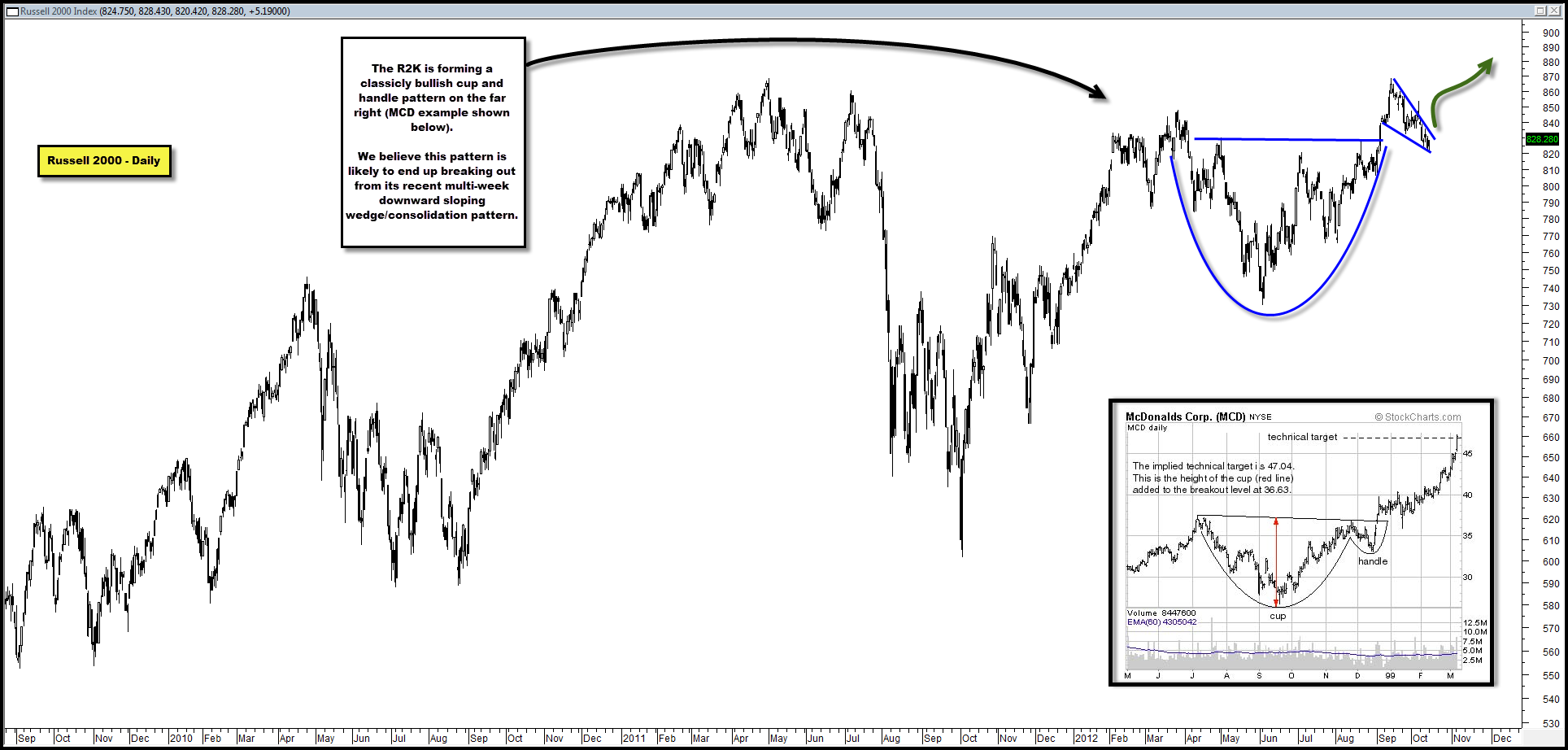

Russell 2000 Forming a Classicly Bullish Technical Pattern That Should be Resolved with Higher Prices

The Russell 2000 is forming a classicly bullish cup & handle pattern in the chart below.

We typically hesitate to talk about technical patterns like these as we believe they are the purview of bloggers/market practitioners that use only technicals in their market analysis tool kit and thus, have nothing else to rely on and are merely grasping at straws when highlighting them.

Our ranting aside, the set-up below seems too clear and obvious to ignore.

Should the R2K break above its recent multi-week descending wedge/consolidation pattern, or the “handle” part of its cup and handle pattern, which we believe is likely, it will probably result in additional upside for the index and be associated with the same for risk assets in general.

In the chart below we include a similar pattern and break-out in MCD in the late 90s to highlight the similarities to the pattern currently forming in the R2K.

Comments are closed, but trackbacks and pingbacks are open.