Airlines Have Greatly Out-Performed the SPX Since late May; More Upside to Come?

Our first post on the airlines and their potential for out-performance moving forward dates back to May 30 in this post.

Since that time, when global risk assets in general were near their corrective summer lows, the S&P 500 Airlines Index has rallied ~12.5% vs. a ~7.7% rally for the SPX itself.

Pretty solid out-performance.

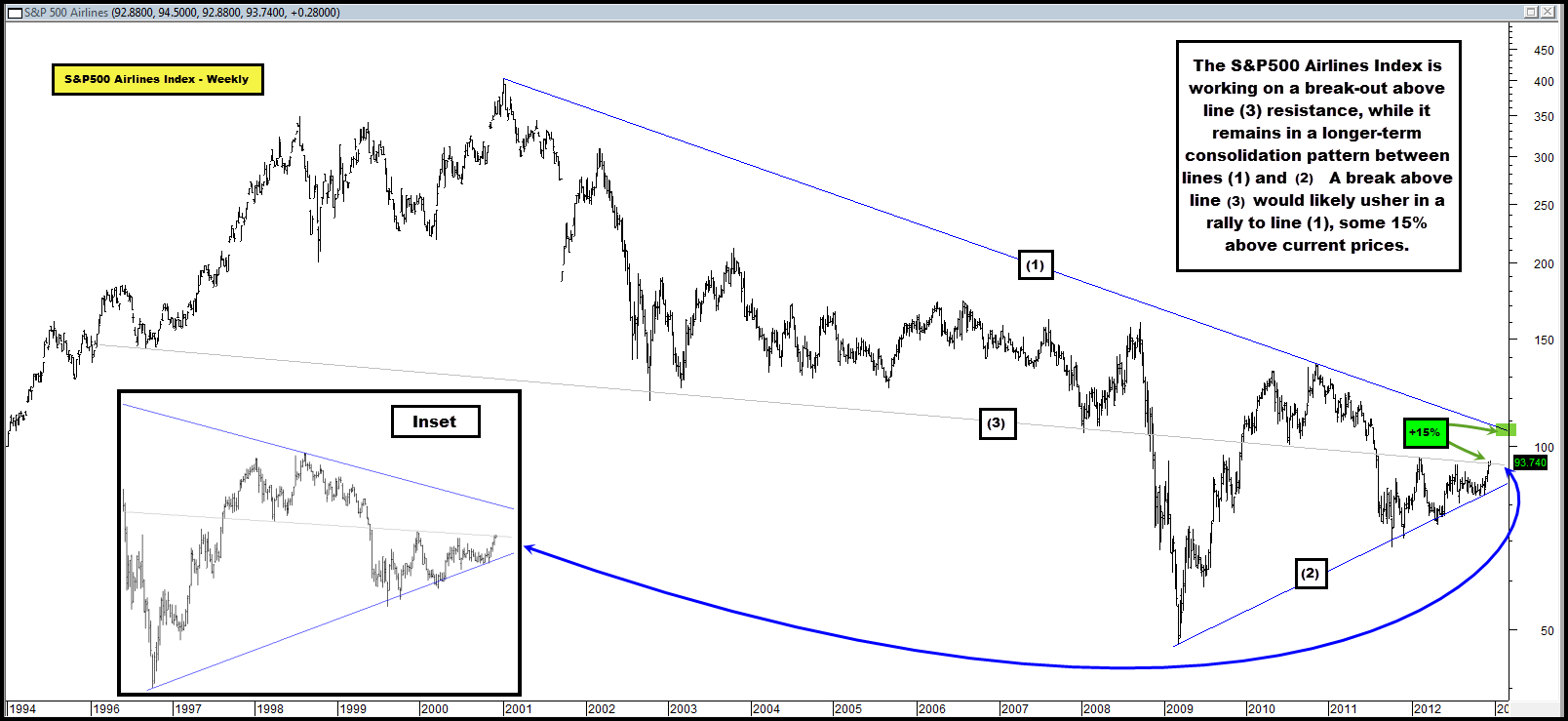

As we look at the chart below, we see that the Airlines Index is close to yet another technical break-out/milestone, as it works to clear long-term resistance line (3).

Should it clear that resistance, it will likely target line (1), some ~15% higher, which marks the top end of a long-term consolidation pattern the index has formed between it and line (2).

Broadly speaking, the core of our airline out-performance thesis is based on the idea that commodities will under-perform equities moving forward, crude oil included, and that the mere possibility of flattish oil prices, much less declines, will act as an ongoing tail-wind for the industry.

So far so good and our thesis remains the same.

Comments are closed, but trackbacks and pingbacks are open.