Bottom Fishing in AAPL Remains Ill-Advised

We’ve been bearish on this name since early October when it stood at $658 all the way back to this post.

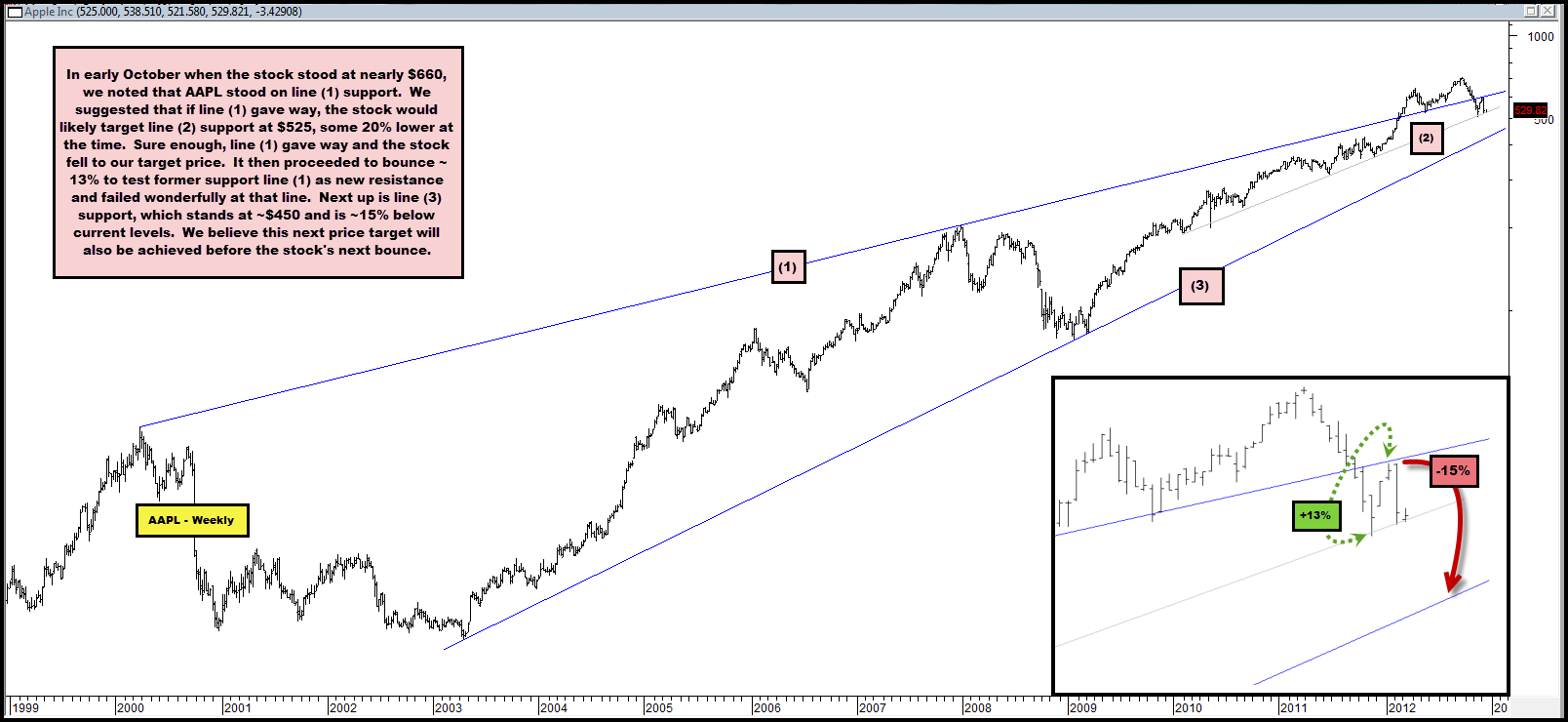

We noted at the time that if support were to give way it would likely fall ~20%-35% lower to at least $525 and likely $425.

Target #1 at $525 was hit right before Thanksgiving and the stock proceeded to bounce nicely, as we suggested it would here, by ~13% in a mere two weeks.

That rally took it back up to test former support line (1) in the chart below as resistance. The stock failed beautifully at that resistance and has resumed its descent.

We remain bearish on the name and believe $450 is the next stop and continue to believe GOOG and YHOO out-perform it moving forward.

Broadly speaking, we believe the great run of AAPL is forever finished.

That said, we are not doom and gloomers on the name and are not portending some imminent collapse in the shares or business.

Rather, we would contend that AAPL is next in line to become a big, lumbering, excessively cash rich tech-giant, similar to MSFT, CSCO, and so on, from days past.

Comments are closed, but trackbacks and pingbacks are open.