BBY Down 22% Since our Bearish Post on 7/12 Despite 5% Rally in SPX Over Same Period; Much More Downside in BBY Likely

Though the post had been pass-word protected up until today, we had a rather bearish post on BBY all the way back on July 12th where we suggested the stock could trade much, much lower from its price at the time, and likely in quick fasion.

In that post we suggested the following:

“Fundamentally speaking, is BBY really any different from Circuit City of days past or RIMM and NOK today?…All three are relics of times past – business models that are now arguably completely antiquated.”

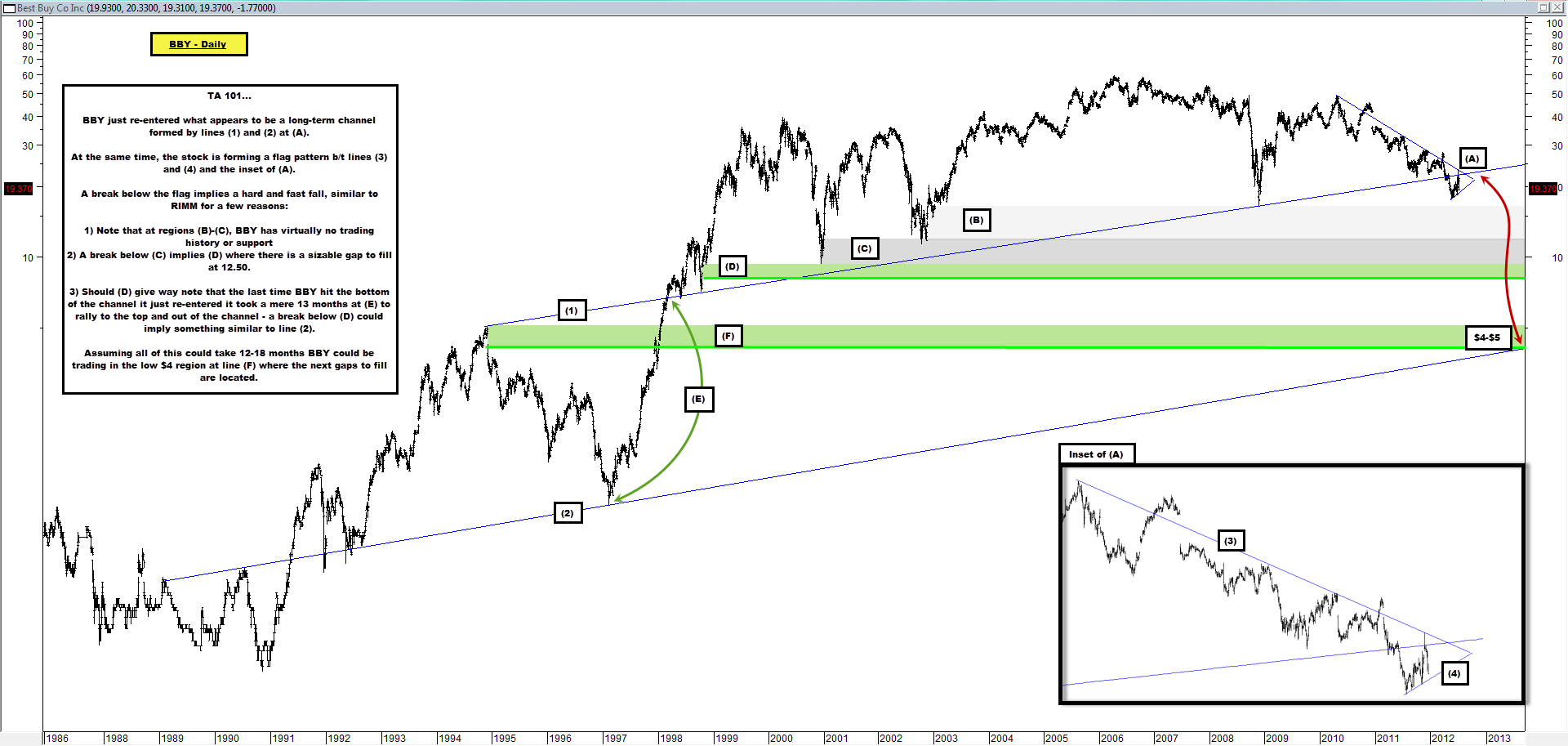

This is the technical chart we presented from that post to justify our bearish fundamental view:

We’ve updated the chart from that original post to reflect today’s price action and continue to believe what we believed back then – this stock remains at risk of material downside.

Our commentary on the chart is nearly identical to that from the original chart presented above.

In the end, we believe this stock will likely target ~$8.50 and before all is said and done, potentially $4. It’s technical set-up is as precariously bearish as they come.

The caveat to all of the above is BBY’s founder – will he attempt to do something irrational by taking this company private at a significant premium to current prices because of ego?

Comments are closed, but trackbacks and pingbacks are open.