Airlines +19% in a Quarter vs. Flat SPX; More Upside Likely?

Here is a link detailing all of our bullish posts on airlines dating back to May 30th of last year.

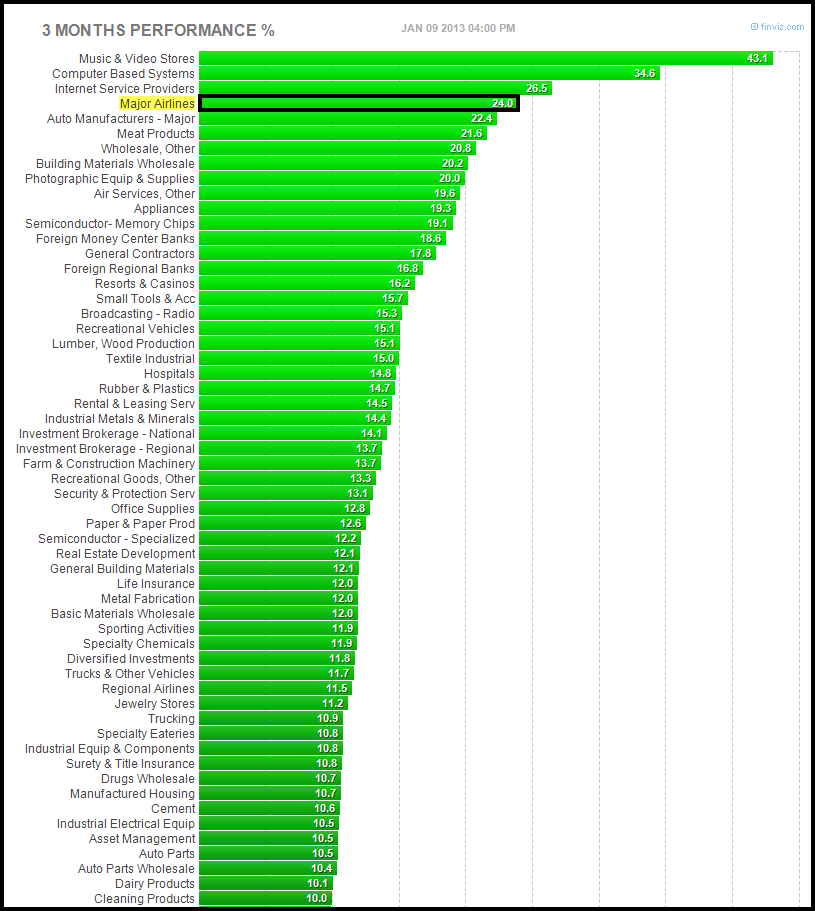

In the past quarter alone, since mid October when we suggested more airline out-performance, the group (via FAA) is up ~19% vs. a flat SPX, making it the fourth best performing industry in the U.S.

That’s some incredible relative out-performance and alpha.

Further, as recently as December 18th we noted in this post that airline out-performance was likely about to accelerate, despite the fact that such out-performance had already been quite robust for some time. Since then, airlines have out-performed by a remarkable 490 bps, in a mere three weeks!

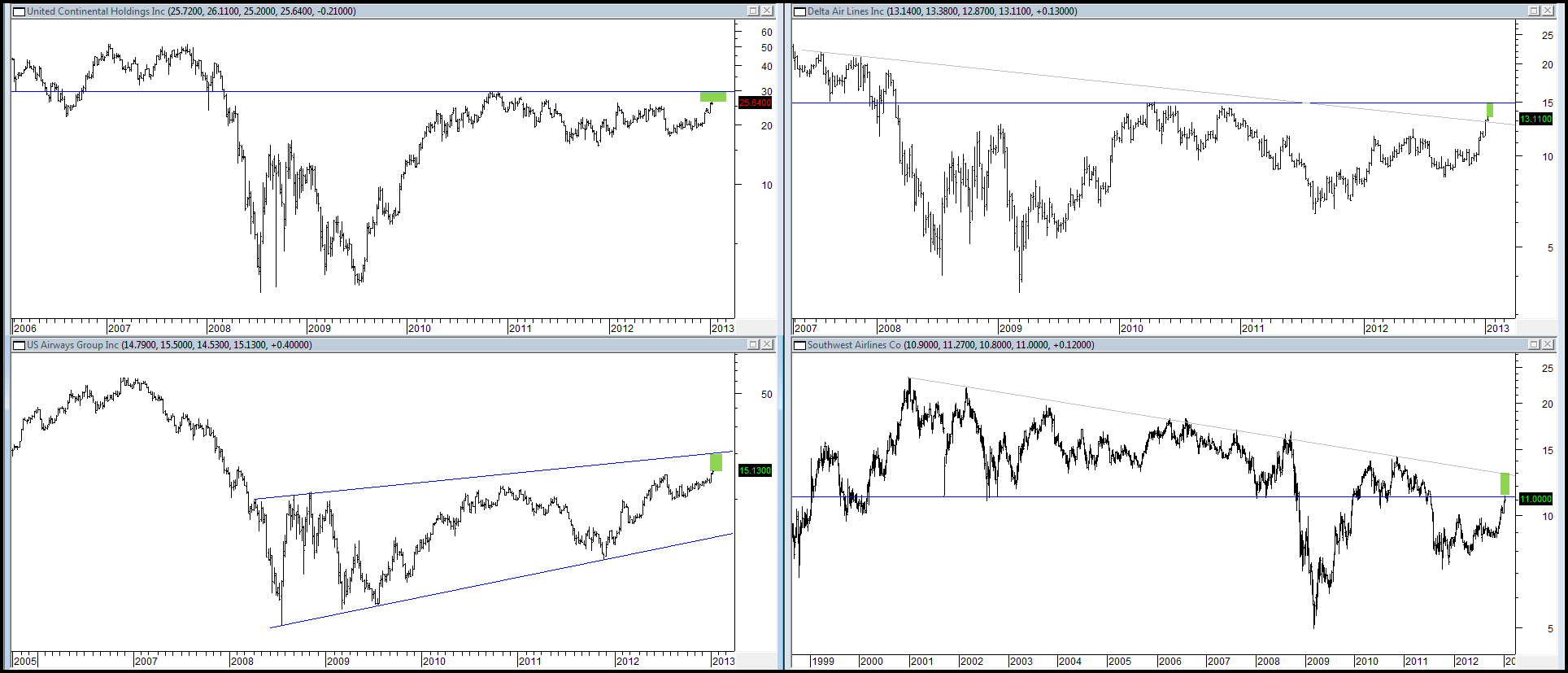

In the chart below, we highlight some key airline players just to simply note that none of them face any critical resistance at the current time.

Does this imply they have more upside on an absolute and relative basis?

Comments are closed, but trackbacks and pingbacks are open.