Euro Likely to Drive Global Sentiment in Near-Term while Silver Hanging by a Thread above $26

On a weekly basis the Euro/Dollar cross finds itself nearing very critical support levels ~ a penny lower at ~1.215.

This is the pair’s 50% Fib level b/t the 2000 low and 2008 high and also represents trend-line support (1) from the 2002/2003/2010 lows.

If risk asset bullish, one would like to see the pair bounce here.

A break of support likely ushers in more global risk asset selling and could imply downside in the cross to the ~1.12-1.13 region (61.8% Fib and trend-line support).

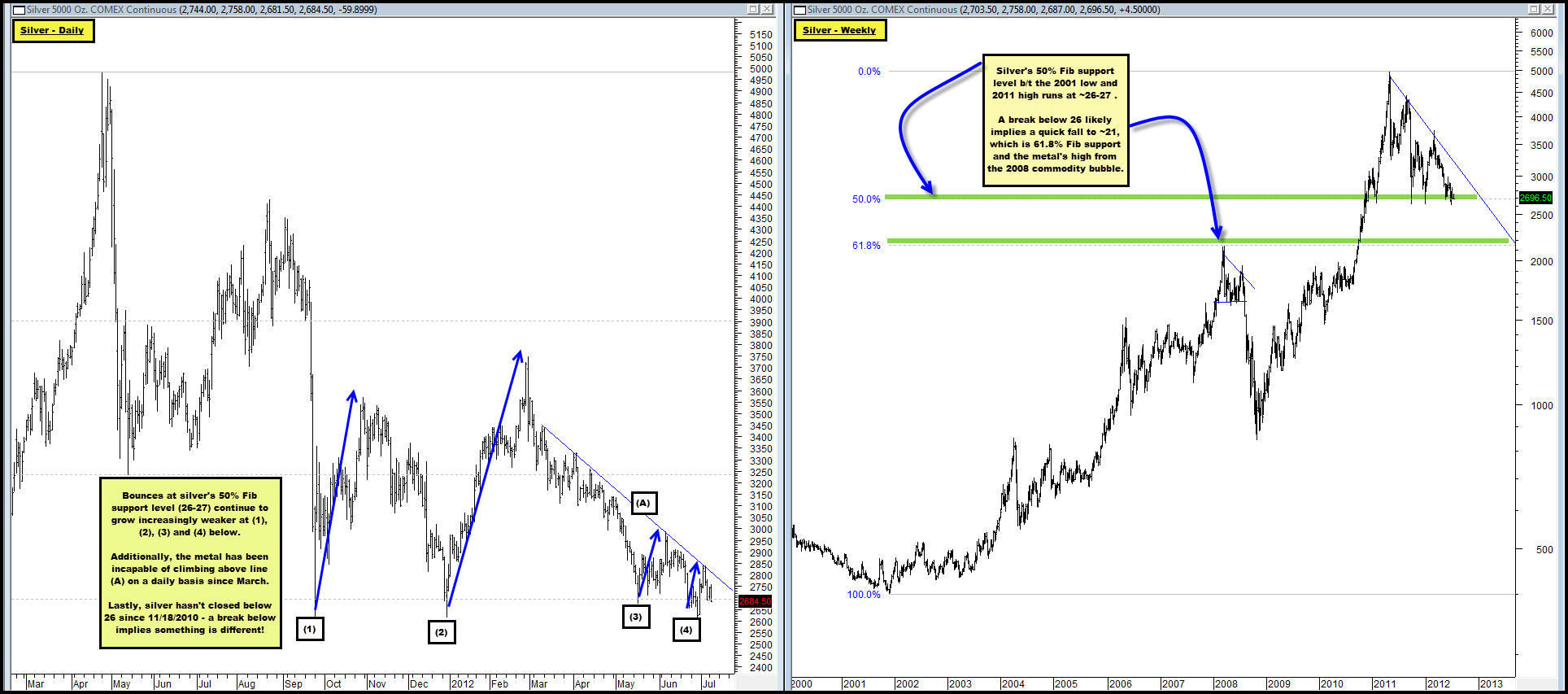

As the Euro finds itself nearing support, silver continues to hang by a thread as it places weaker and weaker rallies off the critical ~$26 level.

A concurrent break of support in the Euro and the ~$26 level in silver could generate downside in the metal of ~20%-30% in short order.

Why is the ~$26-$27 level so important for silver?

It represents ~50% Fib support b/t the 2001 low and 2011 high for one – a location that has produced numerous bounces in recent months and the low point of each material sell-off in the metal since its 2011 highs.

Secondly, silver hasn’t closed below $26 since 11/18/2010.

When prices start printing below this level something has likely changed for the worse.

Comments are closed, but trackbacks and pingbacks are open.