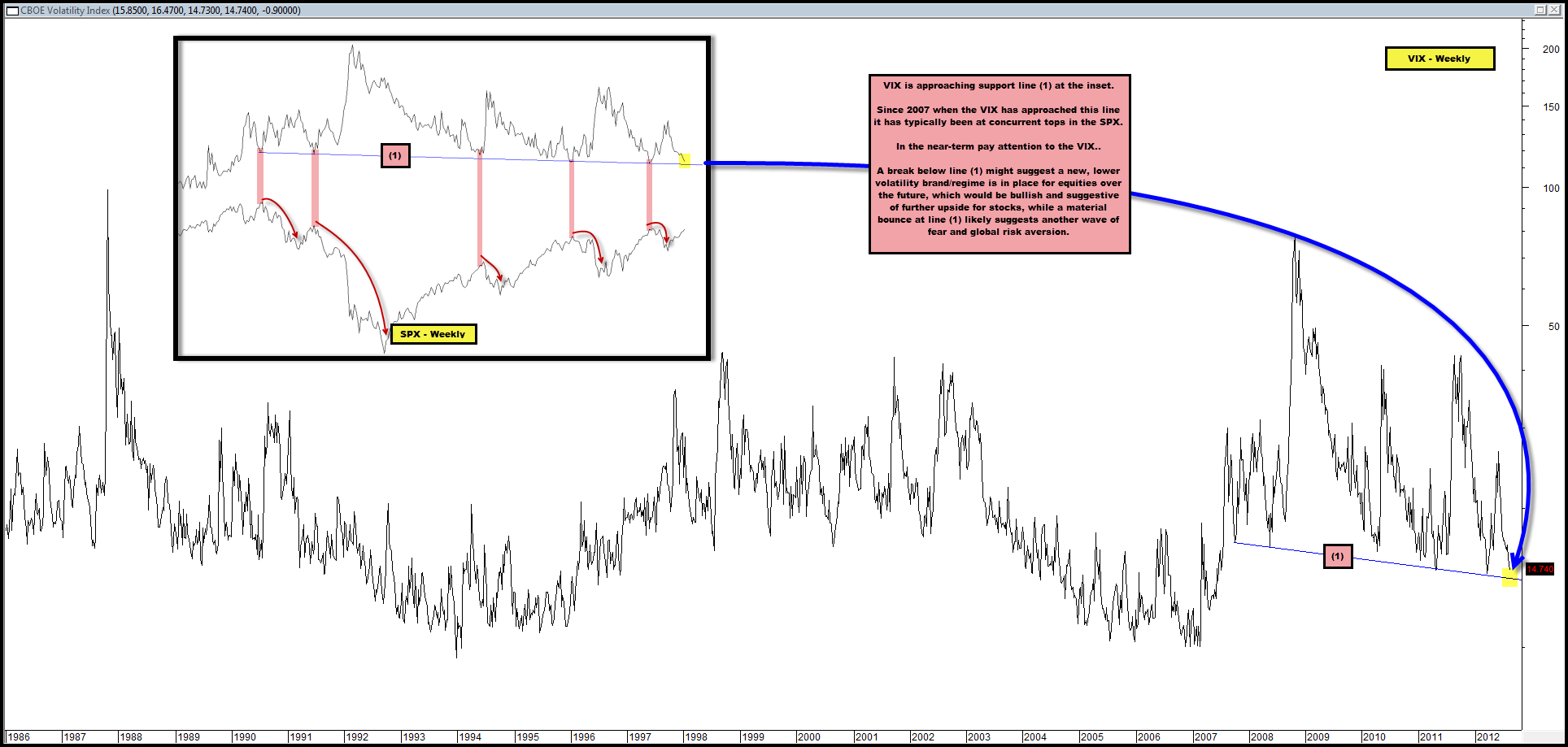

VIX Approaching Long-Term Support; Signaling Global Risks About to Flare?

In the chart below the VIX is approaching long-term support line (1).

Since 2007, it has been along this line where the VIX has experienced its most notable rips and the SPX its most notable dips and tops.

Should the VIX be able to pierce below line (1) sustainably, it could be indicative of a new, lower volatility regime moving forward.

In other words, whatever global risk drivers have been in place since 2007 until now which have helped to produce a floor under the VIX at line (1) have likely ceased to exist or no longer have the same bearish impact as they did before.

This would be broadly bullish for global risk appetite moving forward and could help to drive sustained upside in equities.

If the VIX bounces materially at line (1) in the near-term, all of the above is clearly off the table and we should expect another potential wave of global risk aversion.

Comments are closed, but trackbacks and pingbacks are open.