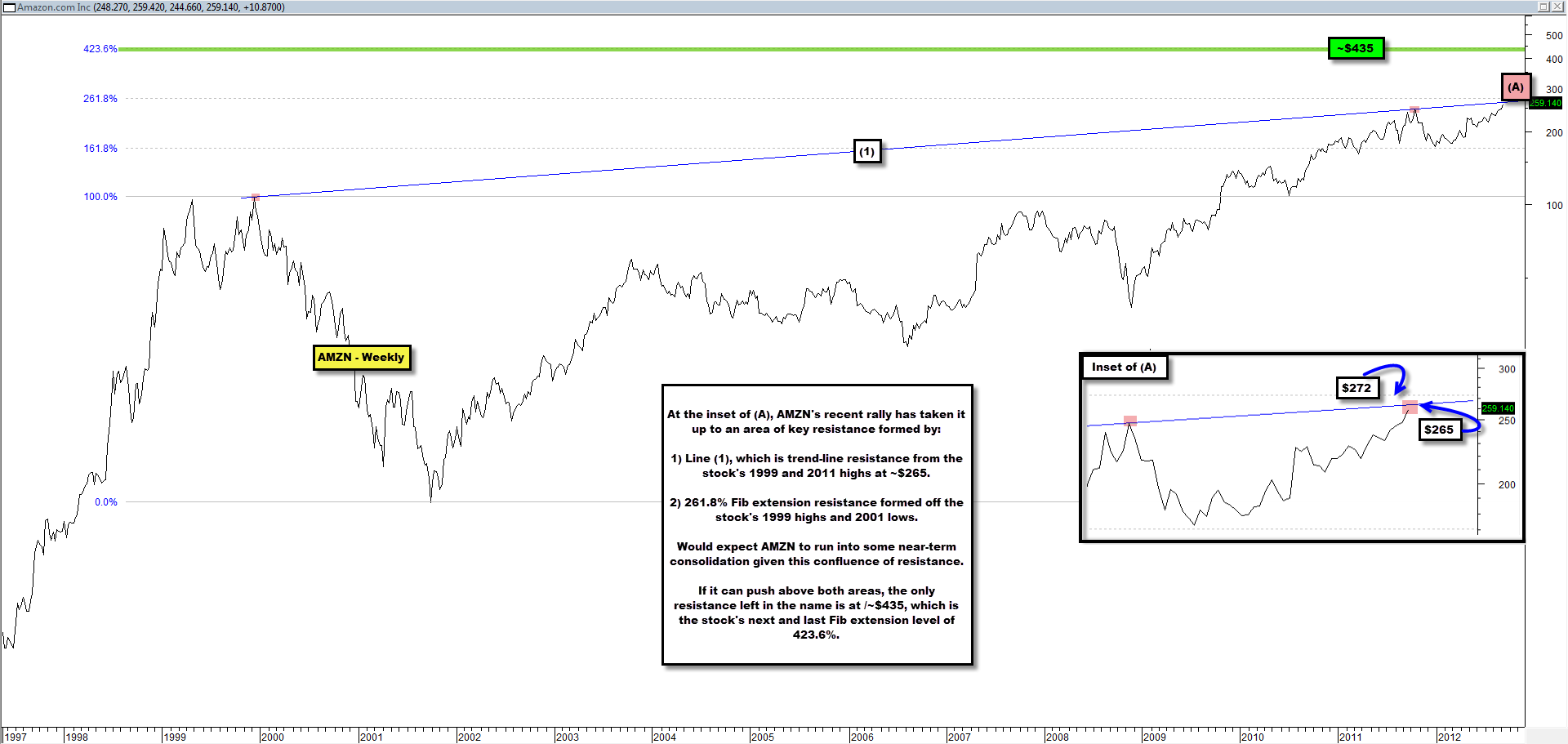

AMZN Entering Critical Area of Resistance; A Break-Out Likely Sets it Up to Target $435

In the chart below AMZN’s rally of late has taken it into a key area of resistance in the ~$265-$272 region.

$265 marks trend-line (1) resistance formed off the stock’s 1999 and 2011 highs.

$272 marks 261.8% Fib extension resistance formed off the stock’s 1999 highs and 2001 lows.

We would anticipate AMZN to consolidate as it enters this region.

If it can push above both key resistance levels, the stock could then target ~$435, or ~65% higher, as this represents AMZN’s 423.6% Fib extension level and its last noteworthy area of technical resistance.

Comments are closed, but trackbacks and pingbacks are open.