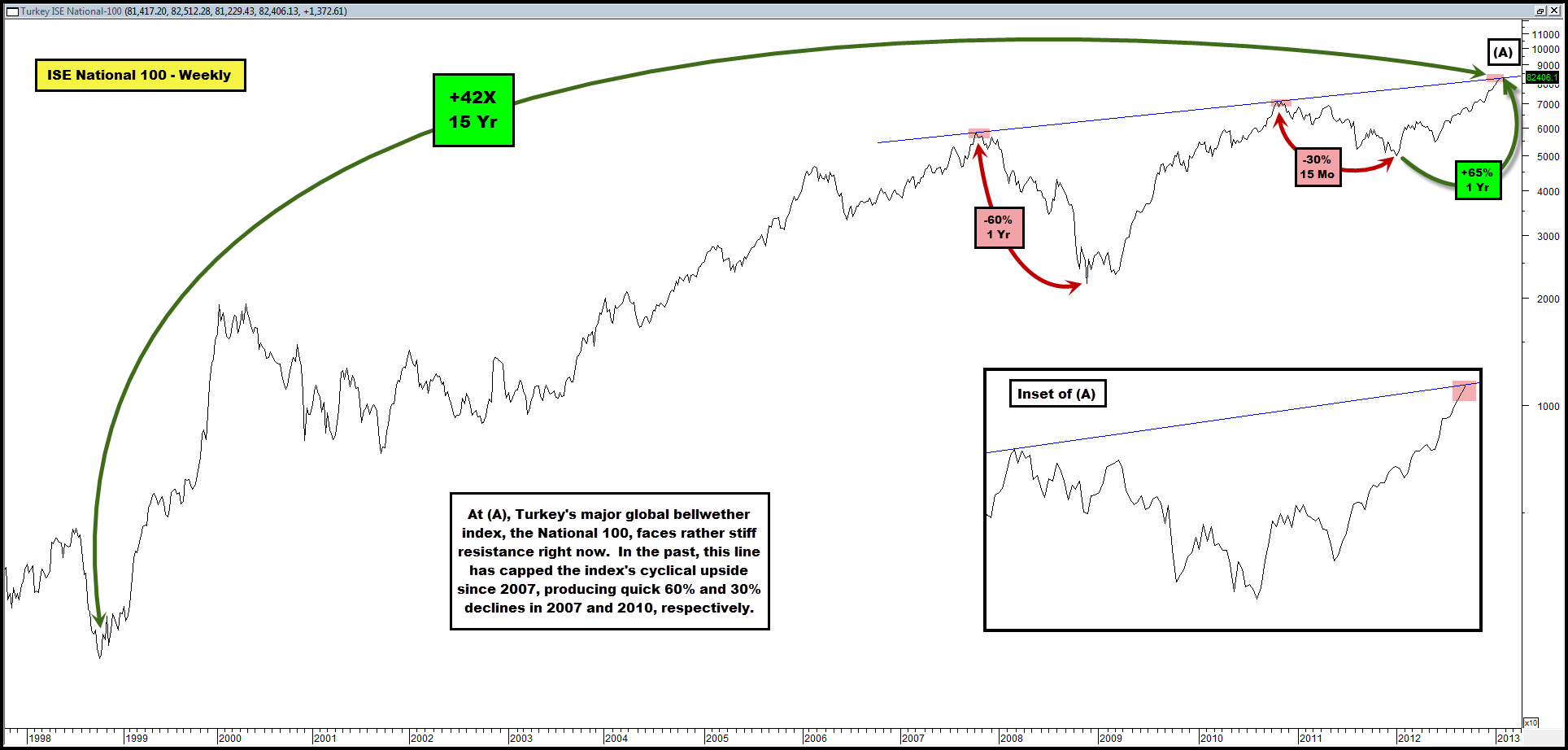

Turkey’s Bellwether Stock Index Faces Resistance that Has Led to Recent Cyclical Bear Markets

Turkey’s ISE National-100 has had an amazing run, up 65% in a single year.

More remarkable is the 42x (yes, 42x) return on the index since the first global risk/banking contagion of 1998 during LTCM’s blow-up.

That said, the index now faces resistance at (A).

This line has capped the index’s cyclical bull markets since 2007 and has helped to produce 60% and 30% declines in 2007 and 2010, respectively.

Will the same happen this time around?

Comments are closed, but trackbacks and pingbacks are open.