Broad European Indices Have Rallied ~15% Since June…Now What?

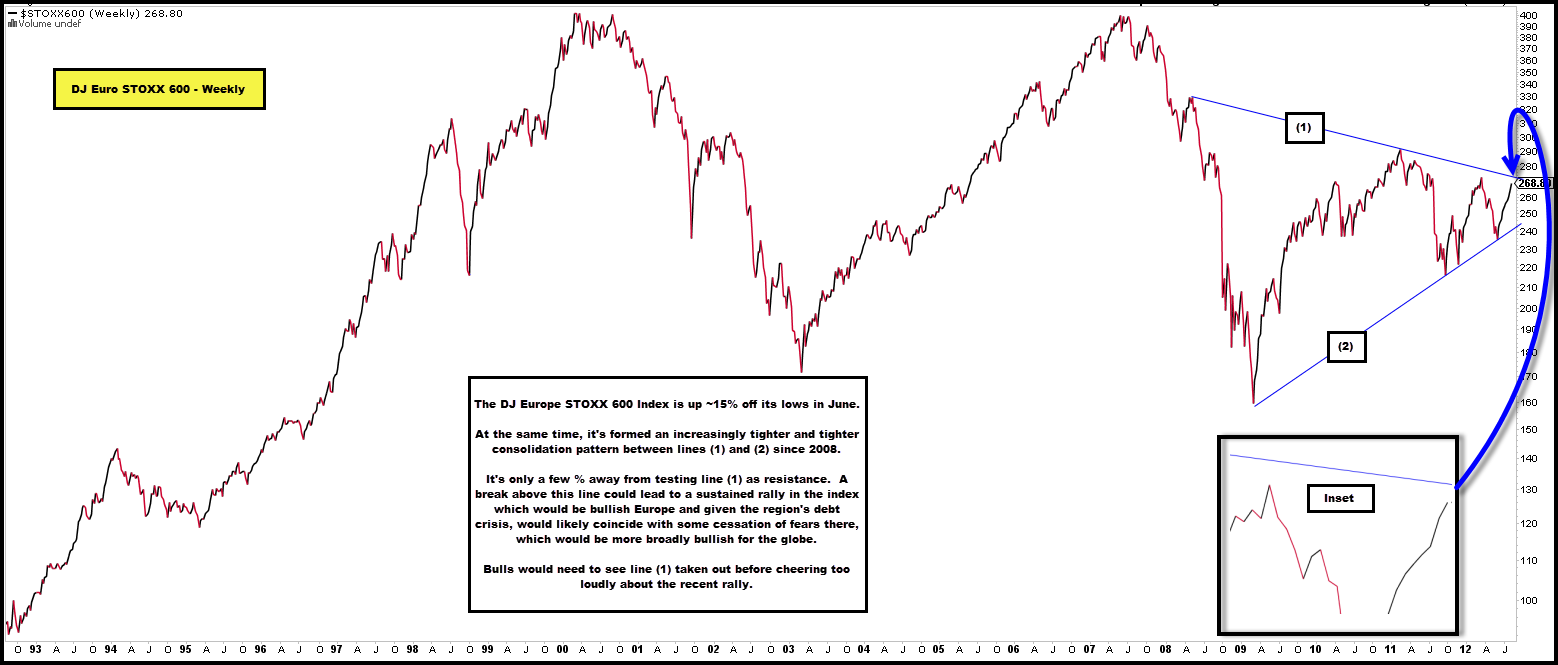

The chart below shows a very broad European index, the DJ Euro STOXX 600, on a weekly closing basis.

The index tested line (2) support in June and since then has rallied nearly 15%.

That rally has brought it to within a few % of testing line (1) as resistance.

Collectively, lines (1) and (2) form an increasingly tight consolidation pattern that’s been in place since 2008.

Before bulls get too excited, line (1) needs to be taken out to the upside.

If this can take place, it likely would be Euro-centric bullish and given the region’s ongoing debt crisis, could coincide with further cessation of fear over that situation spiraling out of control, which would likely be more broadly bullish for the rest of the world as well.

Keep an eye on the technical development in this index though – negative catalysts tend to show up at major resistance points and do positive ones at support.

Comments are closed, but trackbacks and pingbacks are open.