Getting Granular: Negative Divergences b/t Price and Momentum in the SPY

Never want to focus too much on posts like this or make them too frequent as it’s often overly myopic to do so, but thought it’d be worthwhile sharing.

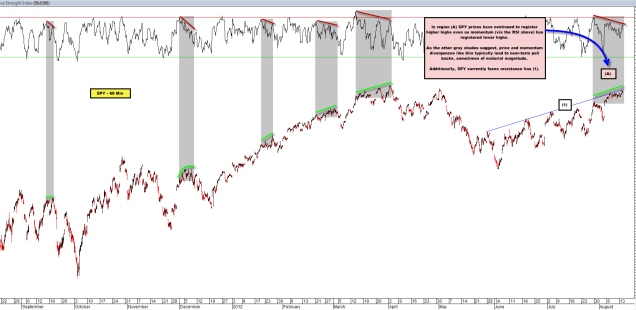

In the chart below in region (A) the SPY has recently gone on to register multiple higher highs in price even as momentum, via the RSI, has registered lower highs.

This is a negative divergence and often times leads to pull-backs in the near-term, sometimes material ones as the other grey shades suggest.

Additionally, SPY faces resistance line (1) which has been capping rallies since mid May.

Comments are closed, but trackbacks and pingbacks are open.