What does the SSEC Continue to See that Global Mining Plays Don’t?

We had a post the other day that suggested price action in the SSEC doesn’t carry much informational content value anymore.

To some degree, YTD results justify this view with the SPX up ~12% and the SSEC down ~7%.

However, what if this view is only partially correct and needs to be qualified?

What if instead, the SSEC’s price action does provide read-throughs to the next major inflection point in global risk appetite, but just on a lagged basis?

As we dug deeper and began comparing how global mining plays such as RIO, BHP, FCX, Copper and JOY act relative to the SSEC, this is indeed what we found.

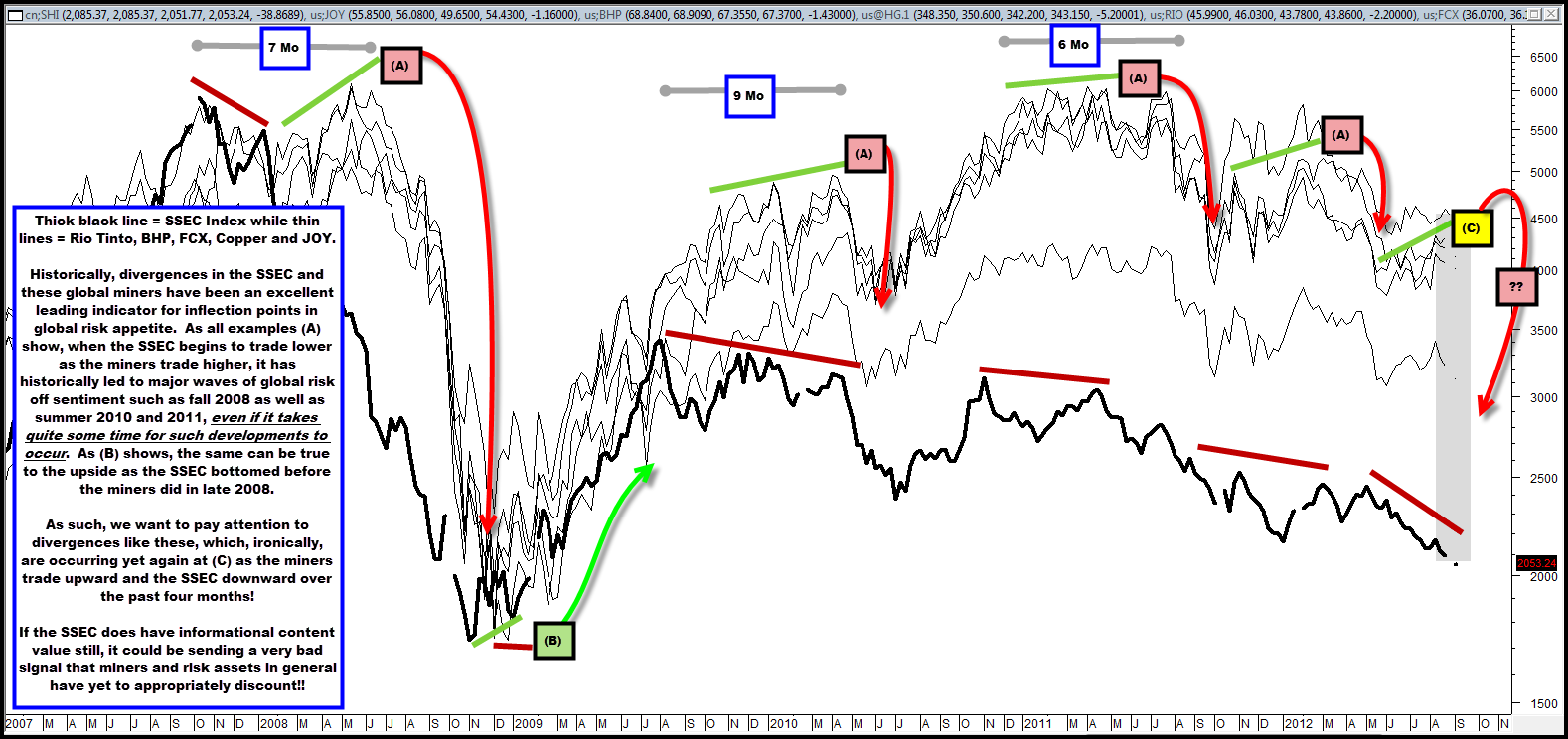

The chart below reflects this reality and compares the SSEC (thick black) vs. the aforementioned global mining plays (thin black).

At all examples (A), the SSEC has quite successfully foreshadowed major inflection points lower in mining related plays (and by default, risk appetite in general), before they have come to fruition since 2007.

The same was true to the upside in 2008 as the SSEC bottomed well in advance of the same mining plays as (B) highlights.

So, with all of the above in mind, what should we make of (C) whereby the SSEC continues to head lower in an accelerated manner even as these mining plays continue to trend higher in lackluster fashion and the fact that the SPX is

up materially YTD as the SSEC is down ~7%?

Comments are closed, but trackbacks and pingbacks are open.