While the USD Could Face Additional Near-Term Downside, the Potential for a Large Rally May be Growing

Broadly speaking, we’ve been bearish and/or neutral on the USD for the past few months.

That said, we’ve also tried to stress the idea that it was likely in the process of putting a durable, long-term bottom in and that the potential for a 1995-2000 style rally was on the rise.

For background on the how the thoughts above have progressed, see these posts here and here.

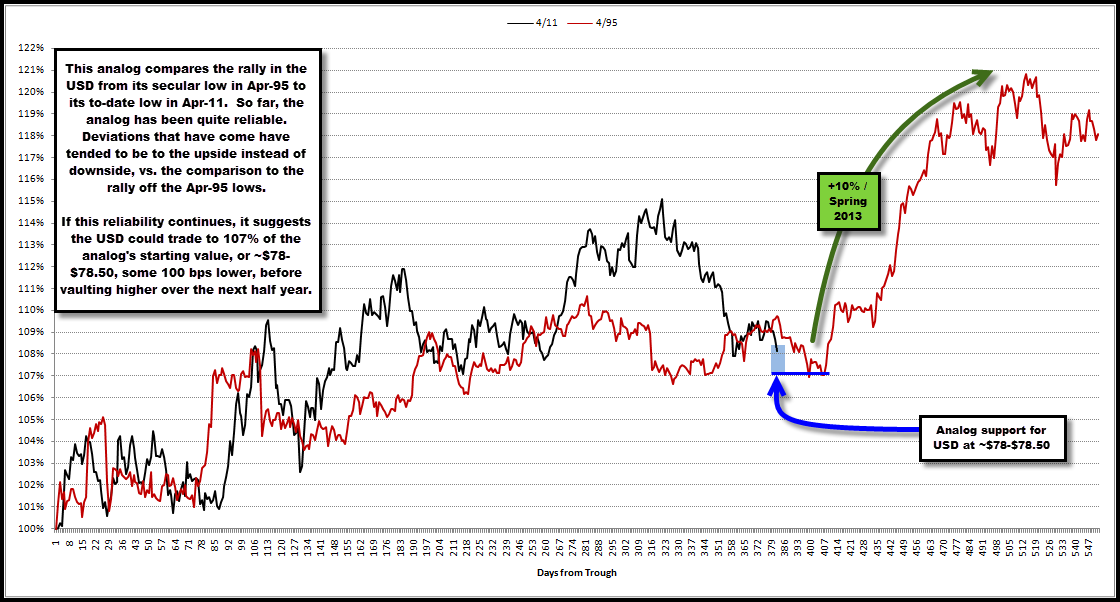

For the most part, our road map for thinking about how this transition might play out has been driven by this analog chart.

That chart suggests the consolidation/bottoming process of 2010/2011 in the USD, as well as the subsequent rally it has enjoyed, is very similar to the path it took in 1994/1995 before it went on to a material, long-term rally into 2000.

With all this in mind, we update the analog comparison below.

It suggests the USD can find support some 100 bps lower, at ~$78-$78.50, in the near-term. It also suggests the possibility of a ~10% rally by Spring 2013 following this bottom.

Note that the analog has been very reliable thus far and nearly all deviations that have occurred, have been to the upside via strength in the current rally, as opposed to the downside.

I would add a technical chart of the USD showing various support lines but in all honestly, the set-up there isn’t clean. It’s not that the USD doesn’t have support on the chart, it’s just that I struggle to find any lines that offer a clear, compelling case for that support.

I don’t want to just goal seek a chart to make it agree with the analog above as I find that analog compelling enough in its own right.

I’ve been struggling with a fundamental catalyst that would spark such a rally in the USD given QE-infinity, but a smart reader pointed out yesterday that a potential Romney win, which would likely result in Bernanke’s removal as Fed chair and the end of the perception of never-ending “dollar debasement”, could provide such a catalyst.

Precious metals could come under pressure and rates could begin to rise as the market realizes that the Fed’s “debasement” and “monetization” programs were likely coming to an end.

All conjecture, but trying to piece it together.

Comments are closed, but trackbacks and pingbacks are open.