The AAPL Experience Highlights the Zero-Sum Nature of Financial Markets

There’s a certain unnamed economic blogger out there that loves to highlight the following maxim in rejecting the “excess cash on the sidelines” argument so incessantly tossed around in the financial media as a data point supporting the likelihood of equity markets trading higher:

“For every financial transaction there is both a buyer and a seller, therefore the amount of cash on the sidelines is irrelevant.”

Though thankful all we financial-proletariat are for this blogger’s wonderfully omniscient, wisdom manna-crumbs from on high, the problem with the banal truism above is that it’s inflexibly academic – while it describes the reason prices apparently don’t fluctuate, it does absolutely nothing to explain why prices do fluctuate.

In our view, an infinitely more helpful, less academic truism might go something like the following:

“While it is true that for every financial transaction there is both a buyer and seller, it is the relative urgency with which each respective party desires to transact that causes prices to fluctuate.”

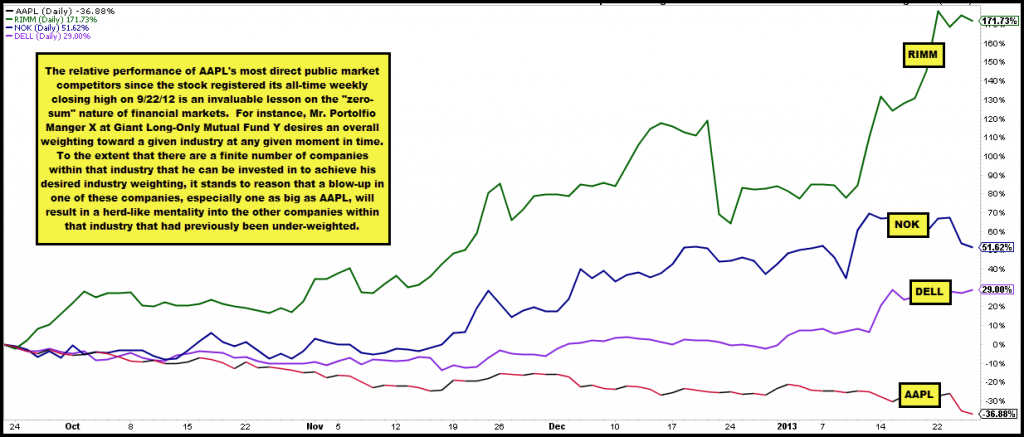

Equipped with the above, we highlight the relative performance of AAPL, RIMM, NOK and DELL from 9/22/12 until now in the chart below. This date represents AAPL’s all-time weekly closing high price, from which it has subsequently lost a couple hundred billion worth of market-cap and ~35% of its value.

What do you notice? Are the differences in relative performance for these companies since that date, all of which are direct competitors, a coincidence?

Or, are the differences indicative of the truism above and the reality that markets are zero-sum in nature?

By zero-sum, what do we mean?

We mean that Mr. Portfolio Manager X at Long-Only Mutual Fund Y desires to have a particular weighting toward the technology hardware industry in his fund at any given moment. Within this industry he achieves his target weight by over-weighting favored companies and under-weighting un-favored ones.

If a favored one (especially “the” favored one) blows up, what happens? His desire to transact in the industry’s respective constituents begins to change.

On the margin, he maintains his weight toward the space but reallocates capital within it, toward names that were un-favored and away from the ones that were favored. His relative urgency to buy formerly un-favored names rises as does his desire to sell formerly favored ones.

In a nutshell, this is the logic that explains the relative performances in the chart below since AAPL peaked.

Yes – every time a fund manager sold some AAPL since 9/22/12 there was a buyer on the other side and vice versa for RIMM. However, with RIMM down 90%+ from its all-time high a few months ago and AAPL up 90x+ from its decade low in 2003, which respective group of company shareholders have likely been the more urgent sellers of late??