Semis Have Badly Under-Performed the Broader Market for Nearly Two Years; What are the Implications?

The implications of the Philly SOX Index under-performing the broader market severely are similar to other recent posts we’ve made about the Russell 2000’s under-performance vs. the SPX as of late as well as how low the ratio of copper vs. gold is by historical standards (i.e., since the early 1980s).

Historically, when high beta, highly cyclical sectors/indices severely under-perform the broader market it is because of one of two things:

1) The world is severely and excessively bearish on the economy’s cyclical growth outlook (1994, 1996, late 1998, early 2009), which in turn will induce a large pivot higher in risk assets in general as this excessively bearish view is reconciled with the reality things are better

or

2) The world is severely and excessively bearish on the economy’s cyclical growth outlook for a reason (early 1998 and 2008) and risk assets in general are on the cusp of a broad move lower that only the higher beta areas of the market have appropriately tipped their hat to

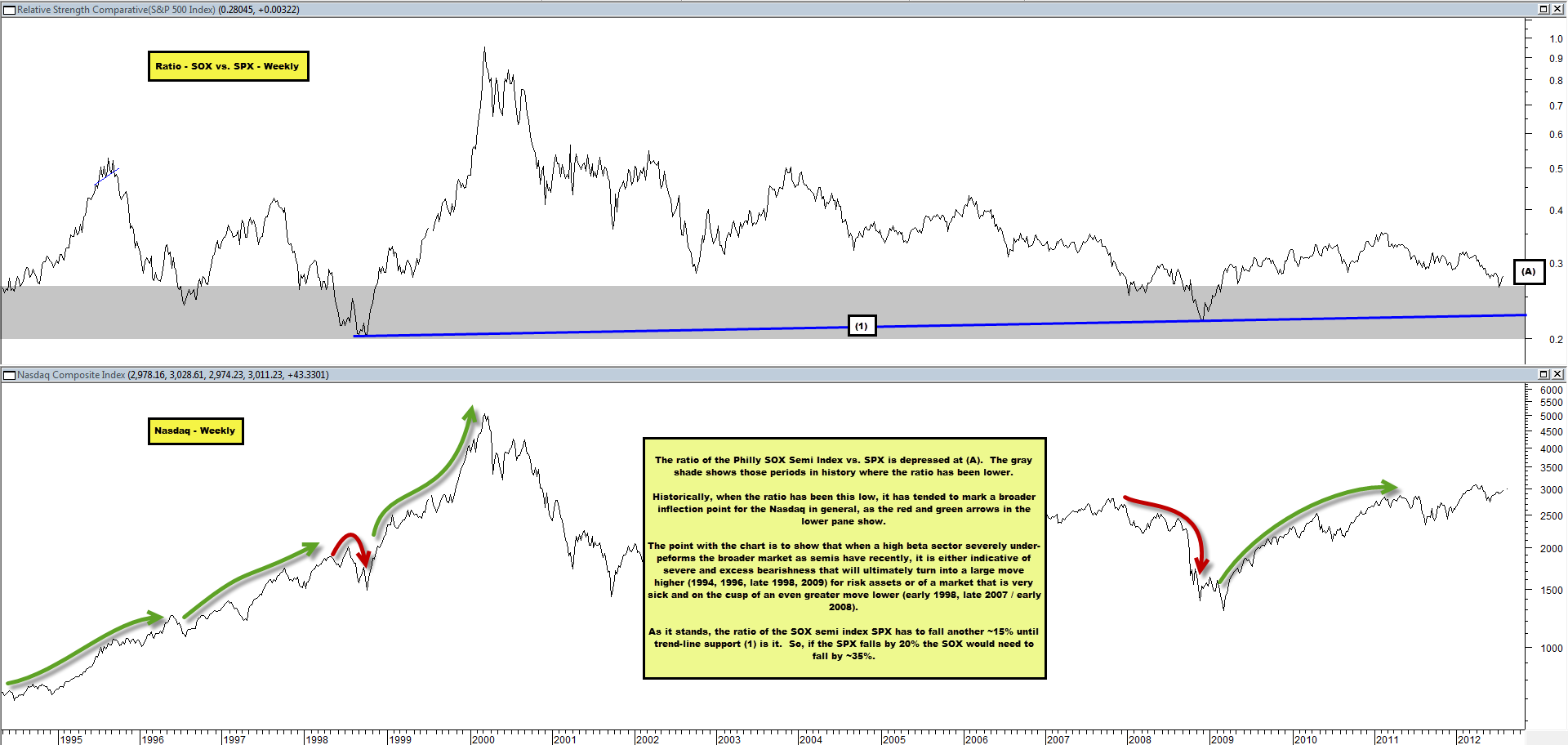

With the latter in mind, we show the ratio of the Philly SOX Index vs. SPX in the top pane and the Nasdaq in the lower pane in the chart below.

The SOX / SPX ratio is quite depressed vs. history – it was lower only a few times since the early 1990s and each one portended a large move either higher or lower for the Nasdaq in general moving forward.

So again, we’ve discussed and posted a lot recently on the idea of financial markets being at an inflection point.

This ratio is but one reason why – lots of things are severely depressed by historical standards (or severely euphoric, such as bonds).

It seems like we’re on the cusp of finding out which ones were discounting reality correctly.

Our only commentary on which view might be correct is that if you believe the bearish pivot is likely the next one, you’re likely betting on a repeat of summer 1998 or fall 2008, both of which represented the height of global financial contagion since the early 1930s as again, the SOX/SPX ratio has really only been lower than its current value over the past 20+ years during those two periods.

Not that it can’t or won’t happen. It’s totally possible. Just know that is what you’re betting on if bearish as based on the ratio b/t the SOX/SPX and how it acts historically, Semis tend to only get more oversold vs. the broader market when such a panic-like scenario is in play.

Comments are closed, but trackbacks and pingbacks are open.