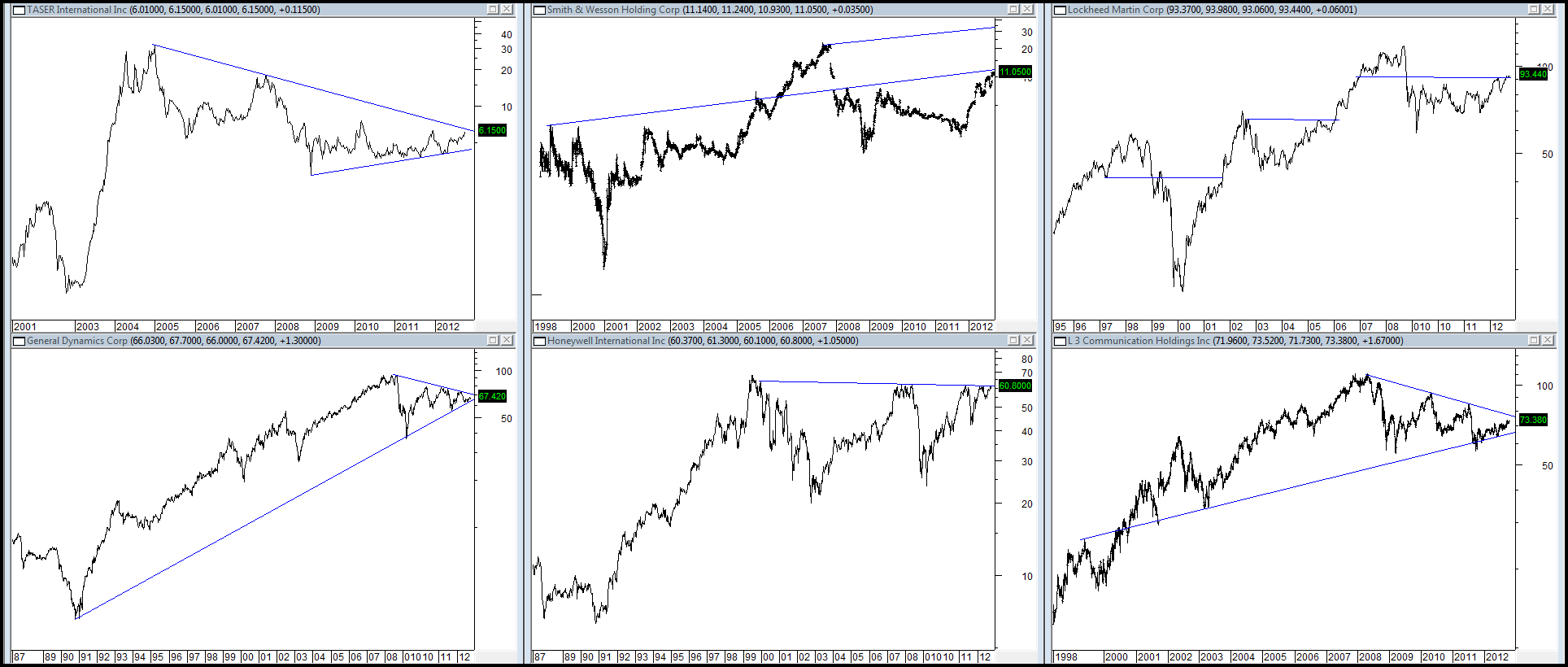

Defense Industry Ready to Out-Perform?

The chart below plots the ratio of the DJ Defense Index vs. the SPX.

From its 2009 highs to its recent lows the ratio declined by ~40% as defense companies have under-performed the broader market materially.

The decline in the ratio has formed a bullish, descending wedge pattern b/t lines (1) and (2) and brought it to long-term support line (3).

Until support line (3) breaks to the downside, we would anticipate that defense stocks could out-perform for some time and that a spread trade long some of the companies below paired with an SPX short might be a solid risk/reward set-up.

Comments are closed, but trackbacks and pingbacks are open.