On a Relative Basis, Gold Miners Face Resistance

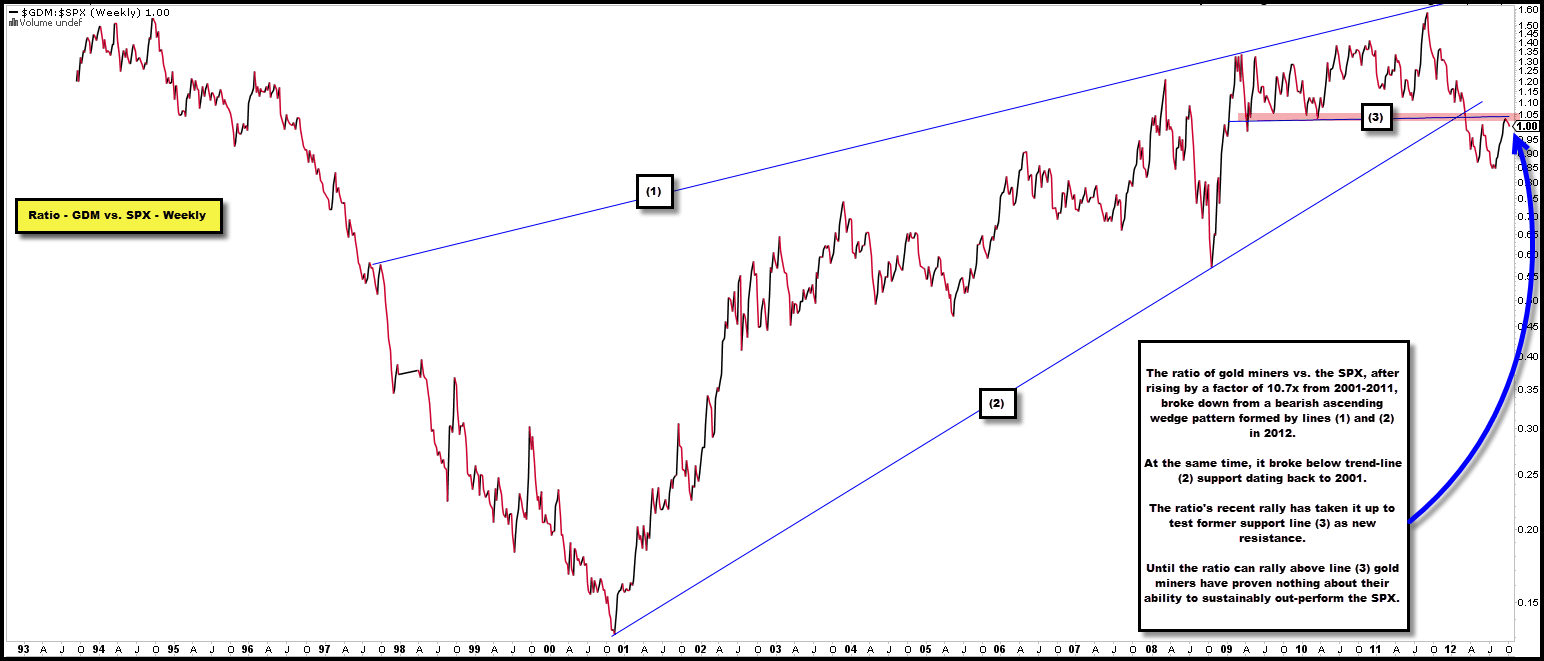

The chart below plots the ratio of Arca Gold Miners Index vs. the SPX.

From 2001 to August 2011, the ratio rose to 1.60 from ~0.15.

This means gold miners as a group out-performed the SPX by a factor of 10.7x.

Simply incredible.

However, from August 2011 to its recent low this summer of ~0.85, the ratio fell by nearly half and broke down from a bearish ascending wedge pattern formed by lines (1) and (2).

Of note, line (2) was trend-line support dating back to 2001.

The general risk on rally over the past few months took the ratio back up to ~1.05 recently, as miners out-performed the broader market.

That rally took the ratio back up to test former support line (3) as new resistance.

Thus far, the ratio is failing at line (3).

Until the ratio can break back above line (3) we would suggest gold miners may sustainably under-perform the SPX on a go forward basis.

A break above line (3) would be quite bullish and negate this view.

Until this happens, the recent rally in miners has proven nothing about their ability to out-perform sustainably.

Comments are closed, but trackbacks and pingbacks are open.