After a 50% Rally in the DAX Barron’s Wants us to ‘Buy Europe’; How Timely is that Call?

Throughout 2012, every time we saw a 5%-10% correction, we heard the “CRASH!” sirens going off.

As we pointed out here during the last such correction into November, the crash had already happened, but it was in 2011 when nobody was expecting it.

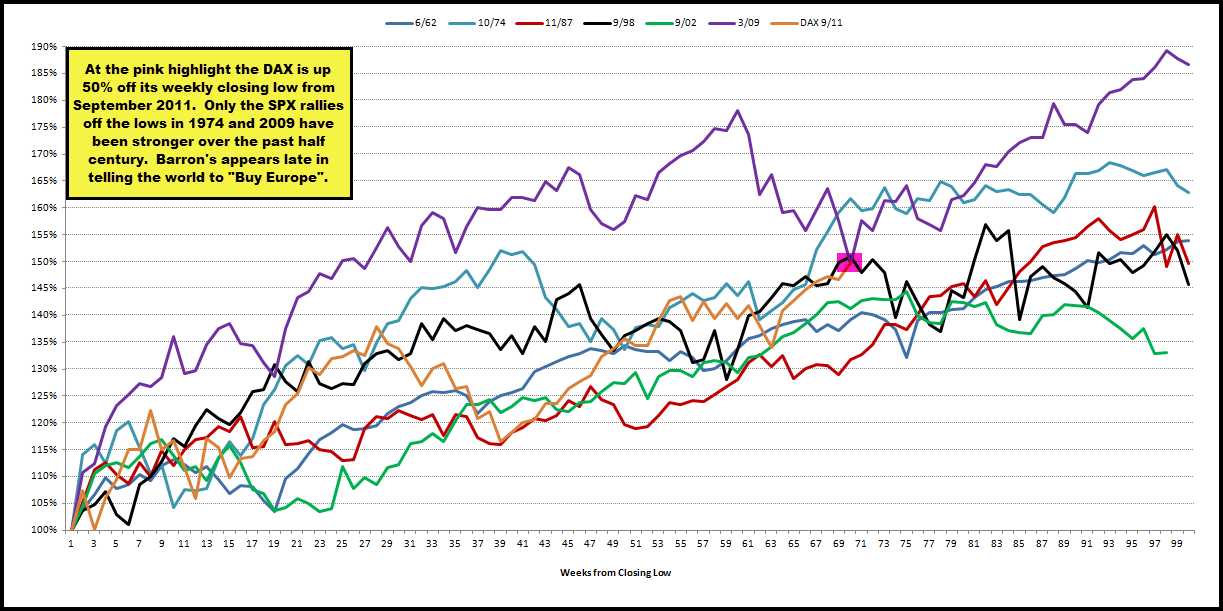

So now, when we fast forward over a year, we find it interesting when we see the likes of Barron’s telling us to buy Europe, after the DAX has risen nearly 50% off its September 2011 weekly closing low.

How timely of a call is that?

And, why is it that the DAX is up 50% from that September weekly closing low already?

What caused the rally?

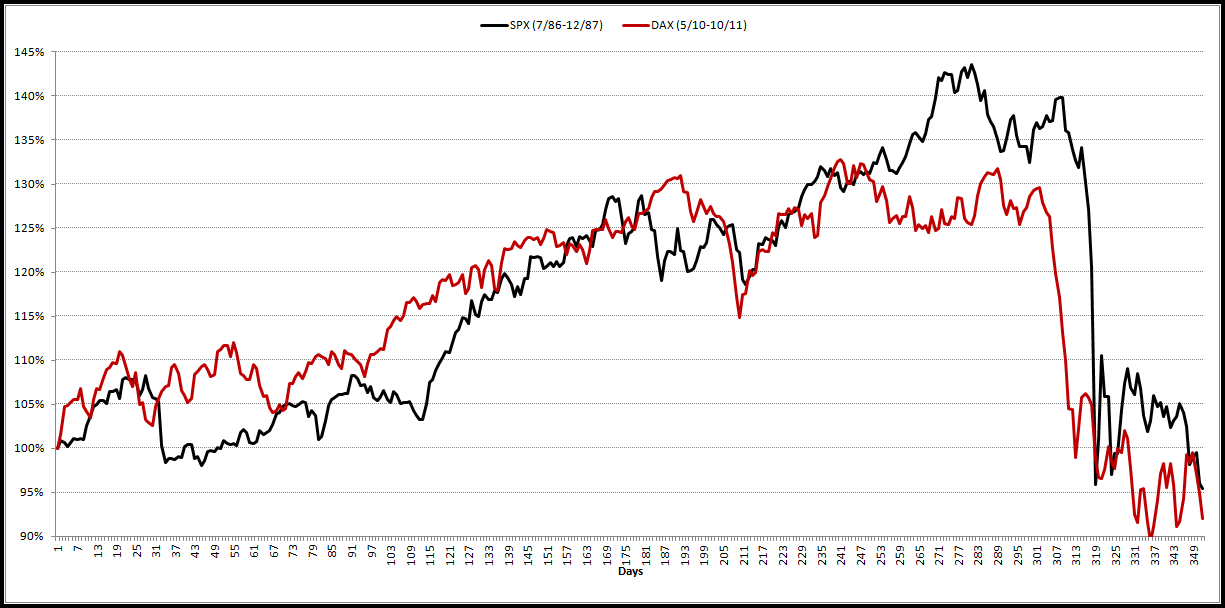

The answer to the latter questions is in the analog below.

It compares the SPX from July 1986 into its crash lows in 1987 with the DAX from May 2010 into its own crash lows from 2011.

Do they look similar?

Yes! The DAX, though it took more than a day, fell ~35% from July 2011 into October 2011.

It crashed!

This analog was very helpful on the way up into 2011, on the way down, and for determining where a major bottom would likely occur via the way the SPX consolidated in 1987.

Analogs are never perfect, but we would be totally blind were it not for road-maps like this.

Crashes tend to produce strong rallies and sure enough, the DAX has done nothing but rip over the past ~14 months.

We compare the DAX rally from September 2011 to SPX rallies off major lows over the past half century. Only the moves off the 45%-50% sell-offs into the 1974 and 2009 lows have produced stronger rallies at this juncture. It’s been stronger than even the move off the 1987 crash lows.

And though the bias for all the other ones was still to the upside, note that they all also suggest the vast majority of gains are already behind us.

Barron’s was way late on this one.

Comments are closed, but trackbacks and pingbacks are open.