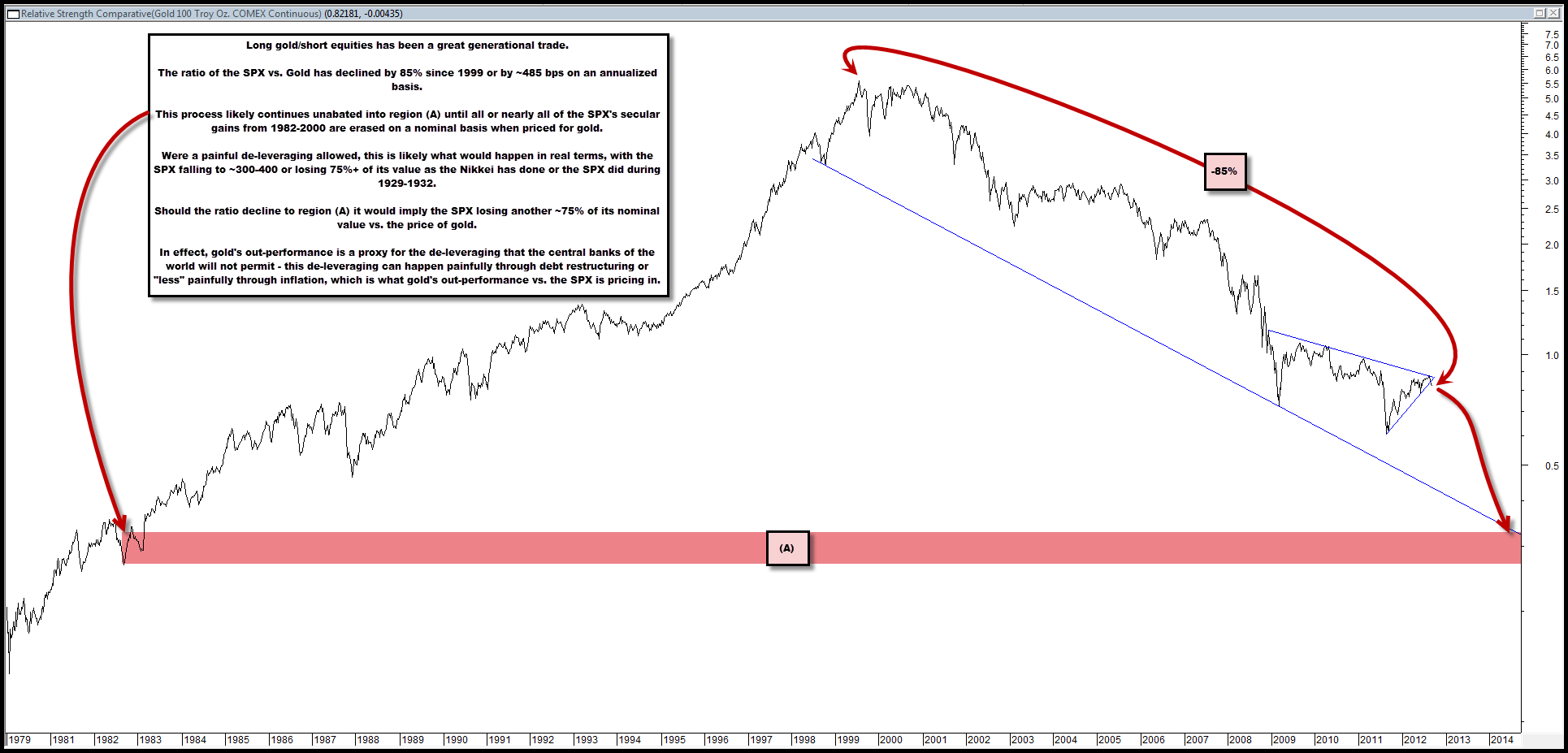

Long Gold / Short Equities Has Been a Generational Trade That Will Likely Continue

Since 1999 the ratio of the SPX vs. gold has declined 85%.

That’s +485 bps annualized for somebody who was short the index and long gold the entire time.

In the end, the logic for this trade remains quite simple:

1) The math of the global debt problem is untenable and intractable

2) The math becomes tenable and tractable in one of two ways including A) painful de-leveraging or B) nominal price increases (inflation)

3) Central banks will not permit A), the painful de-leveraging option, which is facilitated through declines in asset prices such as equities

4) As such, the market will choose option B) by inflating away nominal debt balances and pricing this process in via gold

Ultimately, we believe that if option A) were permitted, the SPX would likely lose ~75%-90% of the gains from its 1982-2000 secular bull run in real terms.

In other words, equities would fall precipitously as have they done in Japan for the past 20 years and as they did in the U.S. from 1929-1932/1937.

Again, because A) is not permitted, this may be much less likely.

Instead, the SPX will merely continue to lose value in nominal terms, when priced for gold.

To eliminate nearly all of the SPX’s secular gains from 1982-2000 when priced in gold, the latter would have to out-perform by another ~75% over the coming years.

This does not mean that along the way there won’t continue to be great individual story stocks or sectors (i.e., AAPL, Pharma for the next decade?) though, so keep this in mind as well.

However, the real story is gold on a secular basis, not equities.

Comments are closed, but trackbacks and pingbacks are open.