USD Finally Going to Find Support & Bounce, Hurt Precious Metals in the Process?

We’ve been broadly bearish on the USD since May.

We’ve outlined the justification for that stance in various posts in the recnent past here and here.

In a nutshell, from a statistical standpoint, history told us that the USD’s recent two-year trading high was likely to lead to the currency’s recent gains slowing and/or reversing over the near/intermediate-term.

Since those posts the USD is down ~200+ bps.

As we revisit the USD, we’re now more inclined to moderate that bearish stance and should price action suggest the need to do so, reverse it to be more bullish.

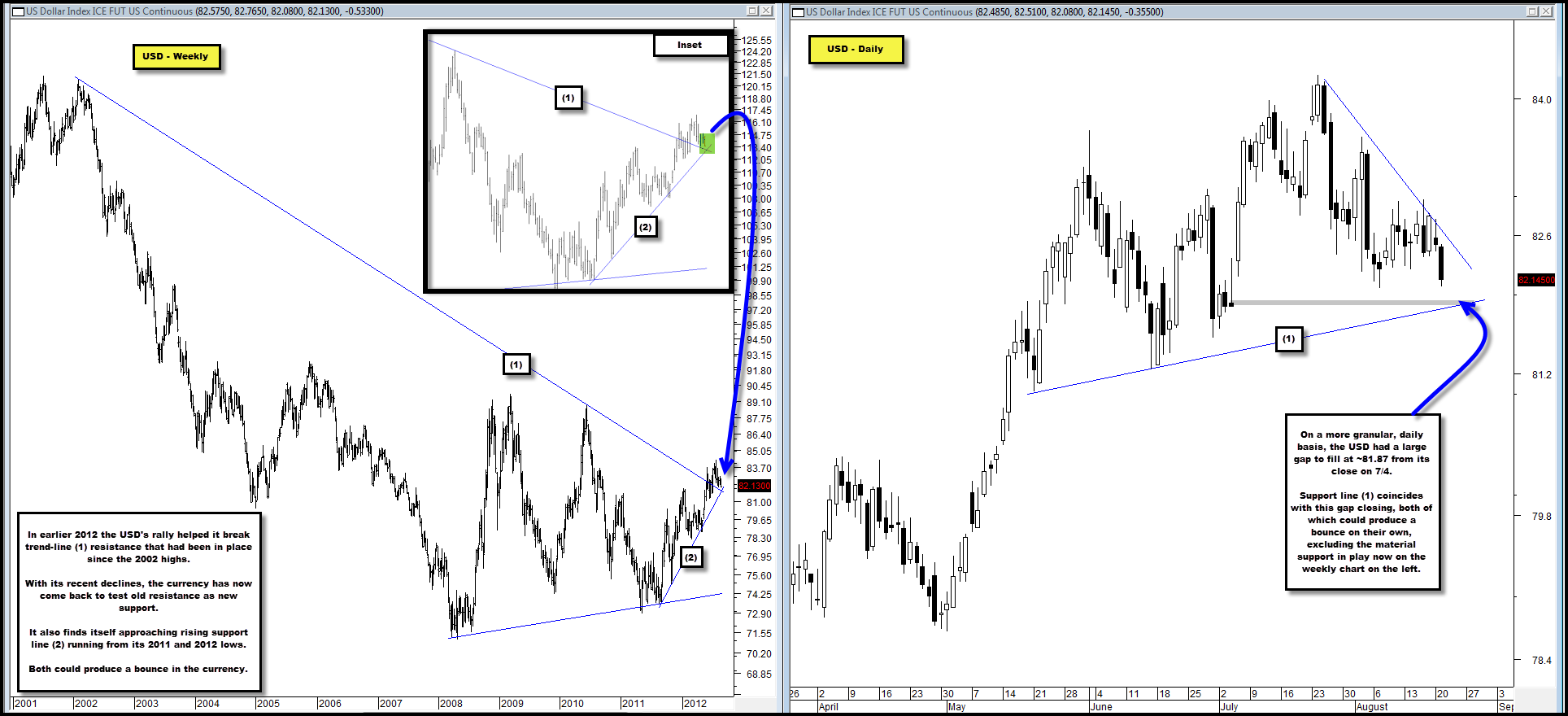

In the weekly chart below the USD broke trend-line resistance (1) from its 2002 highs earlier this year.

With its recent decline it’s come back down to test that old resistance as new support. Further, the currency is approaching rising support line (2) that runs from the 2011 and 2012 lows.

On the daily USD chart the currency is about to close a large gap (gaps tend to always get filled!) from July 4 at ~81.87.

Gap closure would coincide with near-term support line (1) on this chart as well.

Collectively, the technicals on the weekly and daily USD charts support a transition toward strength/support and away from weakness/consolidation, should support hold.

From a longer-term standpoint, we once again present the USD weekly chart below but with more history.

Broadly speaking, the period b/t lines (1) and (2) from 1985-1995 resembles the period b/t lines (3) and (4) from 2002-2011 where the USD ended a ~decade long decline, consolidated for a while and then launched higher for ~five years.

Taking it one step further, there is a chance that region (A) in 1995 is analogous to region (C) from 2011 as the USD consolidated around a decade-long low and that region (B) in late 1996 / early 1997, where the USD finished consolidating the first portion of its rally to begin the second leg higher, is analogous to the current period.

We find the latter analysis interesting to the extent that the USD appears to be reaching both short-term support and a potential inflection point for a broader move higher, as gold and silver’s recent rally has increasingly taken them up to falling resistance from their 2011 highs.

If the USD is about to begin a new leg higher, its impact will likely be felt most prominently in the metals space.

Comments are closed, but trackbacks and pingbacks are open.