Case for Airlines Out-Performing Continues to Build

All the way back on May 30 we highlighted the emerging case for Airlines sustainably out-performing the SPX.

We didn’t take a strong, high conviction stance on this belief, but merely stated the “possibility” for this happening was becoming stronger.

At the time the ratio of the DJ Airlines Index vs. SPX stood at ~0.053 vs. ~0.043 today, meaning Airlines have drastically under-performed by 18% since that post.

This under-performance made us wonder – has the case become more or less compelling now and was the original thought off-base?

We would contend the case is more compelling and the original thought was NOT off-base.

Further, the technical set-up is more clearly in support of the thesis playing out from an execution/timing stand-point.

As such, we are willing to take a more high conviction stance and would suggest owning airlines in the absolute sense or on a hedged basis with a short in the SPX as of right now.

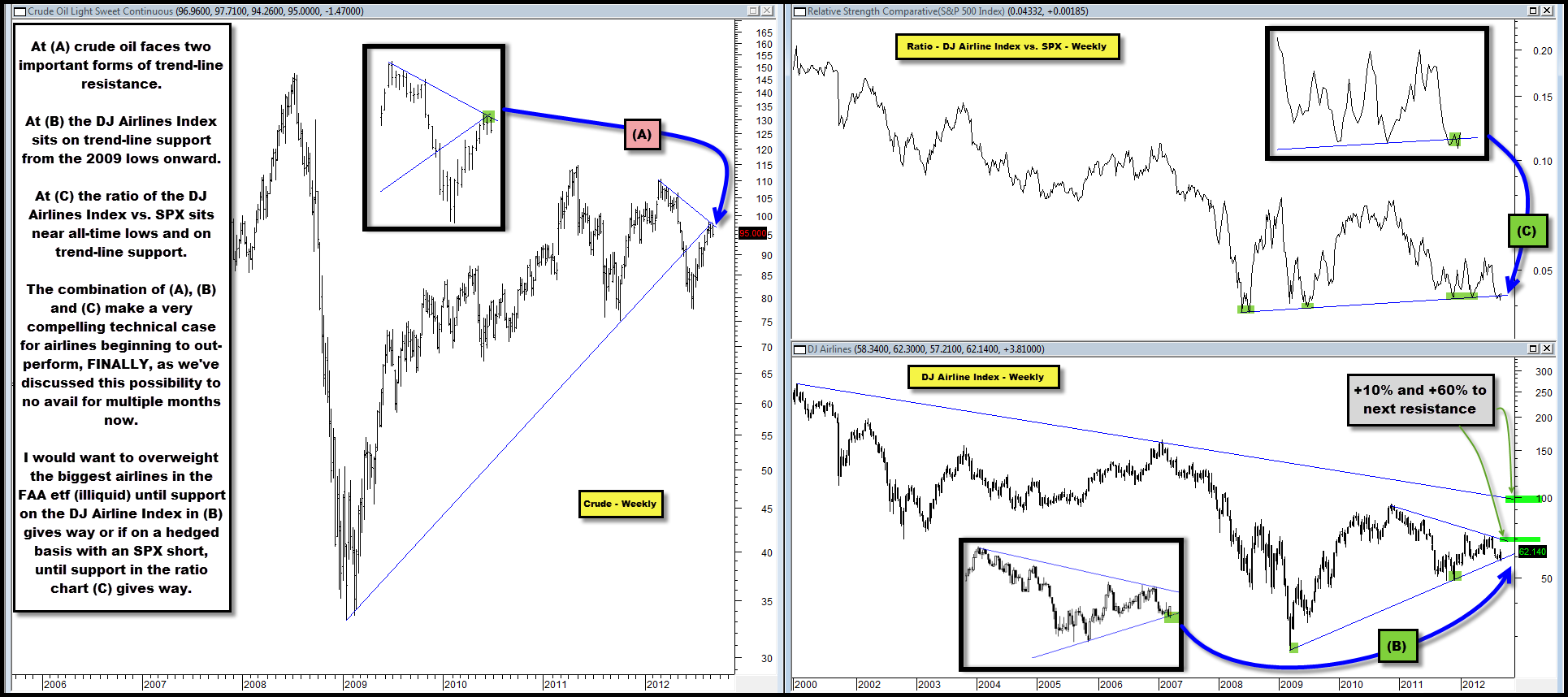

In the chart below, we can see that crude oil faces significant trend-line resistance in (A). It has also been down over the past two days as global equities have ripped!

At the same time in (B), the DJ Airline Index finds itself at signficant trend-line support.

In (C), the ratio of the DJ Airline Index vs. SPX is near all-time lows and is also on trend-line support.

We believe taking a long position in individual airlines in the FAA ETF (i.e., Delta, United, Southwest, etc.) is now a higher probability reward/risk trade.

We would want to be long this group on an absolute basis or with an offsetting short in the SPX until support in chart (B) or (C) gives way, after which we would believe the entire thesis would be wrong.

I know the idea of crude going lower as airlines move higher is ridiculous.

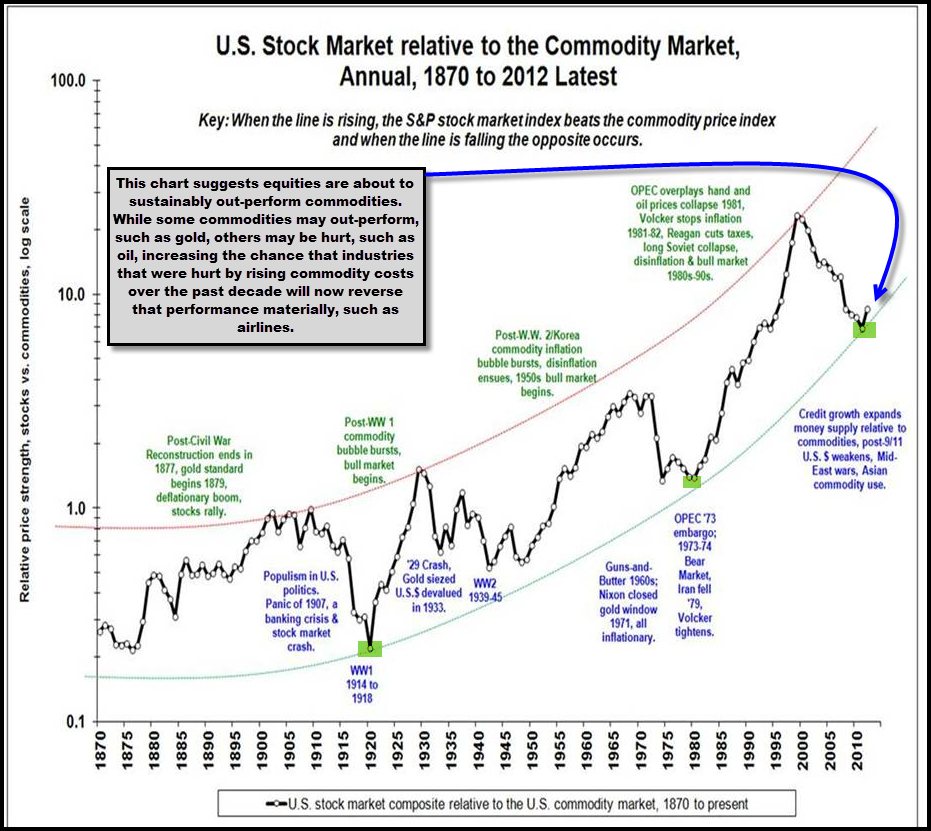

That said, the chart below suggests the commodity wave of the past decade is in fact over and that equities will out-perform on a sustained, secular basis moving forward.

As such, crude could get hurt (not all commodities are created equal – gold could out-perform still).

If so, any industry or group hurt by rising crude or commodity costs over the past decade could reverse that trend materially to the upside over the next cycle, airlines included.

Comments are closed, but trackbacks and pingbacks are open.